Rising Energy Demand

The MEA Renewable Energy Market is experiencing a surge in demand for energy, driven by population growth and urbanization. The region's population is projected to reach over 600 million by 2030, leading to increased energy consumption. This rising demand presents a significant opportunity for renewable energy sources to meet the needs of both residential and industrial sectors. Countries like Egypt and Morocco are actively investing in renewable energy projects to address this growing demand, with Egypt aiming to generate 20% of its energy from renewable sources by 2022. The urgency to diversify energy sources and reduce reliance on fossil fuels further propels the growth of the MEA Renewable Energy Market, as stakeholders seek sustainable solutions to meet future energy needs.

Technological Advancements

Technological advancements play a crucial role in shaping the MEA Renewable Energy Market. Innovations in solar photovoltaic (PV) technology, wind turbine efficiency, and energy storage systems are driving down costs and improving the viability of renewable energy projects. For instance, the cost of solar energy has decreased by approximately 82% since 2010, making it a competitive alternative to fossil fuels in the MEA region. Additionally, advancements in smart grid technology facilitate better integration of renewable energy sources into existing energy systems. These technological improvements not only enhance the efficiency of renewable energy generation but also contribute to the overall growth of the MEA Renewable Energy Market, attracting investments and fostering sustainable development.

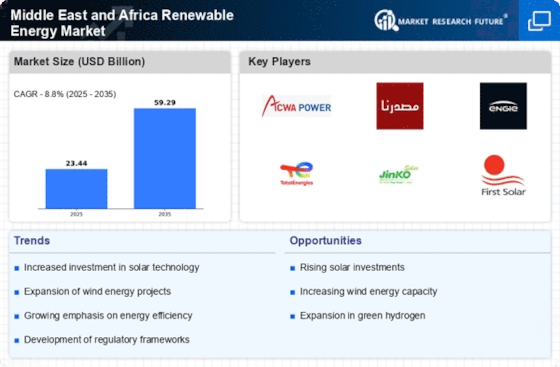

Government Policies and Incentives

The MEA Renewable Energy Market is significantly influenced by government policies and incentives aimed at promoting renewable energy adoption. Various countries in the region, such as the United Arab Emirates and Saudi Arabia, have implemented ambitious renewable energy targets, including the UAE's goal to generate 50% of its energy from clean sources by 2050. These policies often include financial incentives, tax breaks, and subsidies for renewable energy projects, which encourage both local and foreign investments. The establishment of regulatory frameworks that support renewable energy development further enhances the attractiveness of the MEA Renewable Energy Market. As a result, the region is witnessing a surge in renewable energy projects, contributing to economic diversification and sustainability goals.

International Collaboration and Investment

International collaboration and investment are pivotal in advancing the MEA Renewable Energy Market. Various countries in the region are forming partnerships with global entities to enhance their renewable energy capabilities. For example, the Mohammed bin Rashid Al Maktoum Solar Park in Dubai is a result of collaboration with international investors and technology providers. Such partnerships not only bring in capital but also facilitate knowledge transfer and technology sharing, which are essential for developing local expertise in renewable energy. The influx of foreign direct investment (FDI) into the MEA Renewable Energy Market is expected to continue, as countries seek to leverage international resources to achieve their renewable energy targets and enhance energy security.

Environmental Concerns and Sustainability Goals

Environmental concerns and sustainability goals are increasingly shaping the MEA Renewable Energy Market. As the region grapples with the impacts of climate change and environmental degradation, there is a growing recognition of the need to transition to cleaner energy sources. Countries like Qatar and Oman are setting ambitious sustainability targets, aiming to reduce carbon emissions and promote environmental stewardship. The commitment to the Paris Agreement and other international climate accords further underscores the urgency of adopting renewable energy solutions. This shift towards sustainability not only addresses environmental challenges but also enhances the resilience of the MEA Renewable Energy Market, positioning it as a key player in the global transition to a low-carbon economy.