Market Trends and Projections

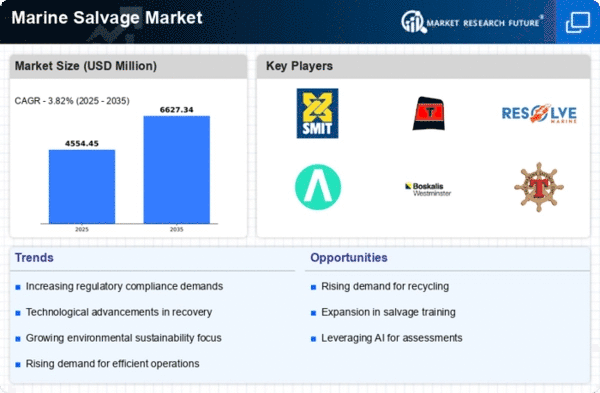

The Global Marine Salvage Market Industry is projected to experience notable growth in the coming years. The market is expected to reach a value of 4.38 USD Billion in 2024, with further growth anticipated, reaching 6.62 USD Billion by 2035. The compound annual growth rate (CAGR) of 3.83% from 2025 to 2035 indicates a steady increase in demand for marine salvage services. This growth is influenced by various factors, including rising maritime trade, regulatory pressures, and technological advancements. The market dynamics suggest a robust future for the marine salvage industry, driven by the need for effective salvage solutions in an evolving maritime landscape.

Increasing Maritime Trade Activities

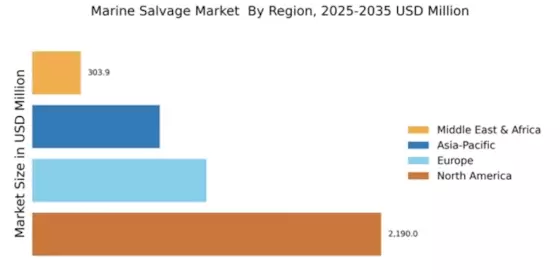

The Global Marine Salvage Market Industry is poised for growth as maritime trade activities continue to expand. In 2024, the market is valued at approximately 4.38 USD Billion, driven by the increasing volume of cargo transported via shipping routes. The rise in global trade, particularly in Asia-Pacific regions, necessitates robust salvage operations to mitigate risks associated with maritime accidents. As shipping traffic increases, the likelihood of incidents requiring salvage services also escalates, thereby enhancing the demand for marine salvage operations. This trend suggests a potential for sustained growth in the industry, with projections indicating a market value of 6.62 USD Billion by 2035.

Rising Incidents of Maritime Accidents

The frequency of maritime accidents, including shipwrecks and oil spills, is a key driver of the Global Marine Salvage Market Industry. As global shipping activities intensify, the likelihood of incidents requiring salvage operations increases. These accidents often result in significant economic losses and environmental damage, prompting immediate salvage responses. The need for timely and effective salvage operations to mitigate these impacts is paramount. Consequently, the industry is expected to grow as stakeholders recognize the importance of preparedness and rapid response capabilities. This trend underscores the necessity for robust salvage services in safeguarding maritime interests and the environment.

Growth of the Offshore Oil and Gas Industry

The expansion of the offshore oil and gas sector is a notable driver of the Global Marine Salvage Market Industry. As exploration and production activities increase in challenging marine environments, the risk of accidents and equipment failures rises. This necessitates the availability of specialized salvage services to address potential incidents swiftly. The offshore industry is characterized by complex operations, often requiring advanced salvage techniques and equipment. As the sector continues to grow, the demand for marine salvage services is likely to increase, reflecting the industry's reliance on effective salvage operations to ensure safety and environmental protection.

Regulatory Compliance and Environmental Concerns

The Global Marine Salvage Market Industry is significantly influenced by stringent regulatory frameworks aimed at environmental protection. Governments worldwide are enforcing regulations that mandate the safe removal of wrecks and hazardous materials from marine environments. This regulatory landscape compels shipping companies to engage salvage services to ensure compliance and avoid hefty fines. The increasing awareness of environmental sustainability further drives the demand for efficient salvage operations. As a result, the industry is likely to experience growth, with a projected CAGR of 3.83% from 2025 to 2035, reflecting the importance of adhering to environmental standards in maritime operations.

Technological Advancements in Salvage Operations

Technological innovations are transforming the Global Marine Salvage Market Industry, enhancing the efficiency and effectiveness of salvage operations. Advanced equipment and techniques, such as remotely operated vehicles and sophisticated sonar systems, enable salvage teams to assess and recover sunken vessels more effectively. These advancements not only reduce operational costs but also improve safety for salvage personnel. As technology continues to evolve, it is expected that the industry will see increased investment in modern salvage solutions, further driving market growth. The integration of technology into salvage operations appears to be a critical factor in meeting the demands of a rapidly changing maritime landscape.