Market Share

Marine Hybrid Propulsion System Market Share Analysis

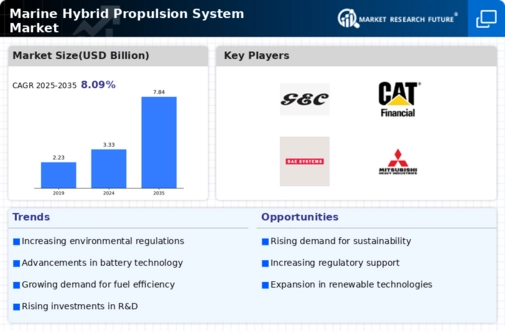

The marine hybrid propulsion system market is experiencing significant changes as a consequence of various factors that are remaking the face of the shipping industry. One major drift in this sector is towards more green practices and fuel efficiency. Hybrid propulsion systems have emerged as a possible solution for lowering emissions and increasing efficiency as ship operators are looking to reduce their environmental footprint. They combine electric propulsion with traditional internal combustion engines so that ships can run on both conventional fuels and cleaner electricity. This trend matches global moves to counter climate change and comply with stricter regulations in relation to pollution within the maritime industry.

Moreover, trends in Marine Hybrid Propulsion System market are also being impacted by adoption of alternative fuels. There is an increasing interest in incorporating hybrid systems that can function on other forms of fuels rather than conventional fossil fuels like hydrogen, liquefied natural gas (LNG), or biofuels; thus reducing dependency on them. This shift signifies the industry’s commitment to diversify energy sources, reduce greenhouse gas emissions, and contribute to sustainable maritime future. Consequently, manufacturers are making investments into research and development to enhance compatibility of hybrid propulsion systems with different alternatives.

Additionally, market dynamics of marine hybrid propulsion systems are shaped by advancements in battery technology. Vessels today have batteries capable of storing large amounts of electric power over long periods due to advances such as high capacity, high performance batteries among others. With better battery technology, fully electric and hybrid-electric propulsion systems become feasible, offering lower fuel consumption rates, reduced maintenance expenses and better maneuverability capabilities among others. This trend reflects a wider push for electrification across transportation which has extended its influence into Maritime.

Furthermore, digitalization combined with smart technologies is another important feature concerning marine hybrid propulsion system market trends. Advanced control systems sensors and connectivity products help ship owners realize efficient performance from their hybrid propulsions through optimization.This means that smart technologies can provide real-time data on fuel consumption patterns while also giving information on the health of an entire system, thereby enabling decision makers to take initiatives that will help them save energy and increase their overall efficiency. This trend aligns with broader shifts in the industry towards digital transformation and the adoption of Industry 4.0 concepts for maritime operations.

Furthermore, newbuilds and retrofitting old vessels are increasingly being hybridized in the maritime sector. There is a growing realization among ship owners of economic and environmental benefits associated with hybrid propulsion systems upgrades to their fleets. Retrofitting allows vessel operators to improve their fleet by making it more efficient, while also ensuring that they comply with changing environmental regulations. This trend comes at a time when decarbonization becomes important for marine industries as they seek to create sustainable options within their shipping lines.

Leave a Comment