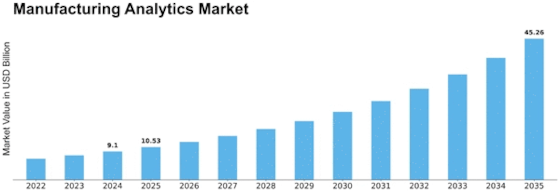

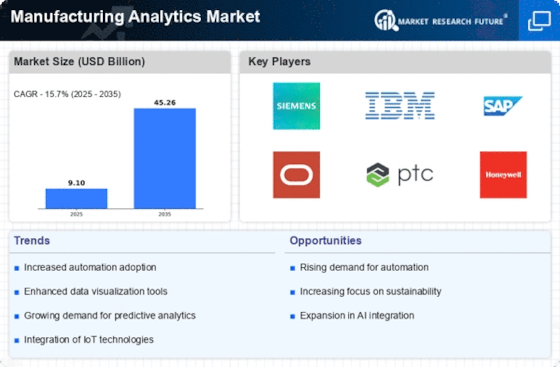

Manufacturing Analytics Size

Manufacturing Analytics Market Growth Projections and Opportunities

The Manufacturing Analytics Market is a dynamic landscape driven by the continuous evolution of technology and the increasing demand for data-driven insights in the manufacturing sector. Companies operating in this market employ various market share positioning strategies to gain a competitive edge and capitalize on the growing opportunities.

One prevalent strategy is differentiation, where companies focus on offering unique and innovative solutions that set them apart from competitors. This could involve developing advanced analytics tools with specialized features tailored to specific manufacturing processes or industries. By providing distinct advantages, such as improved efficiency or cost savings, companies can carve out a niche for themselves and attract a dedicated customer base.

Another key strategy is cost leadership, where companies aim to become the most cost-efficient option in the market. This involves streamlining operations, optimizing resources, and offering competitive pricing to attract budget-conscious customers. Cost leadership can be particularly effective in price-sensitive markets, where customers prioritize affordability without compromising on quality.

Market segmentation is a strategy that involves targeting specific customer segments with tailored solutions. Companies analyze the diverse needs of the manufacturing sector and create specialized analytics tools for different industries or production processes. This allows them to address unique challenges and provide targeted value propositions, enhancing their appeal to specific customer groups.

Strategic partnerships and collaborations are increasingly common in the Manufacturing Analytics Market. Companies form alliances with technology providers, system integrators, or industry players to complement their offerings and expand their reach. Collaborative efforts can result in integrated solutions that combine analytics capabilities with other technologies, creating comprehensive solutions that appeal to a broader customer base.

Geographical expansion is another strategy employed by companies to increase their market share. As the manufacturing industry is global, companies seek to establish a presence in key regions to tap into local markets and leverage regional expertise. This may involve setting up subsidiaries, forming distribution agreements, or acquiring local companies to strengthen their position in specific geographic areas.

Continuous innovation is crucial in the Manufacturing Analytics Market, given the rapid advancements in technology. Companies invest in research and development to stay at the forefront of analytics capabilities. By consistently introducing new features, functionalities, or even entirely new products, companies can attract early adopters and position themselves as leaders in the market.

Customer-centric strategies focus on building strong relationships with clients. This involves understanding customer needs, providing excellent customer support, and actively incorporating customer feedback into product development. Satisfied customers are more likely to become loyal advocates, positively influencing the company's reputation and attracting new business through word of mouth.

Leave a Comment