Advancements in Predictive Maintenance

Predictive maintenance is emerging as a critical driver within the Manufacturing Analytics Market. By utilizing advanced analytics and machine learning algorithms, manufacturers can predict equipment failures before they occur, thereby minimizing downtime and maintenance costs. This proactive approach not only enhances operational efficiency but also extends the lifespan of machinery. Recent studies indicate that predictive maintenance can reduce maintenance costs by up to 30% and increase equipment availability by 20%. As manufacturers seek to optimize their operations and reduce unexpected failures, the adoption of predictive maintenance solutions is expected to rise. Consequently, the Manufacturing Analytics Market is likely to witness substantial growth as organizations invest in technologies that facilitate predictive insights and enhance their maintenance strategies.

Rising Demand for Real-Time Data Analytics

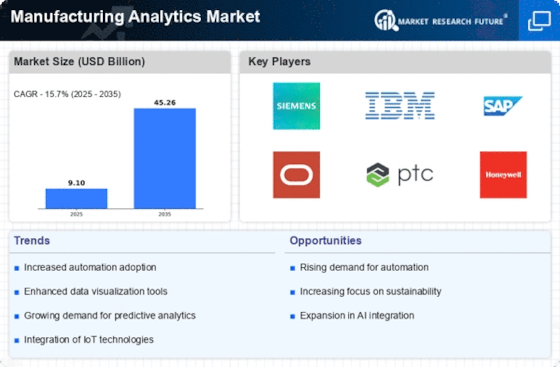

The Manufacturing Analytics Market is experiencing a notable surge in demand for real-time data analytics. This trend is driven by the need for manufacturers to enhance operational efficiency and make informed decisions swiftly. Real-time analytics enables companies to monitor production processes continuously, identify bottlenecks, and optimize resource allocation. According to recent data, the market for real-time analytics in manufacturing is projected to grow at a compound annual growth rate of approximately 25% over the next five years. This growth reflects a broader shift towards data-driven decision-making, where manufacturers leverage analytics to gain a competitive edge. As organizations increasingly recognize the value of immediate insights, the Manufacturing Analytics Market is likely to expand significantly, fostering innovation and improving overall productivity.

Growing Emphasis on Supply Chain Optimization

Supply chain optimization is becoming a focal point within the Manufacturing Analytics Market. Manufacturers are increasingly recognizing the importance of efficient supply chain management in enhancing competitiveness and profitability. By leveraging analytics, organizations can gain insights into supply chain dynamics, identify inefficiencies, and improve inventory management. Recent data suggests that companies utilizing advanced analytics for supply chain optimization can achieve cost reductions of up to 15%. As the manufacturing landscape becomes more complex, the need for sophisticated analytics solutions to streamline supply chain operations is likely to grow. This trend indicates a promising future for the Manufacturing Analytics Market, as businesses invest in technologies that facilitate better supply chain visibility and responsiveness.

Integration of Advanced Robotics and Automation

The integration of advanced robotics and automation technologies is significantly influencing the Manufacturing Analytics Market. As manufacturers strive to improve productivity and reduce labor costs, the adoption of robotics has become increasingly prevalent. These automated systems generate vast amounts of data, which can be analyzed to optimize production processes and enhance quality control. The market for industrial robotics is anticipated to reach USD 70 billion by 2026, reflecting a robust growth trajectory. This integration not only streamlines operations but also provides valuable insights into manufacturing performance. As a result, the Manufacturing Analytics Market is poised for growth, driven by the need for manufacturers to harness data from automated systems to make informed decisions and improve overall efficiency.

Increased Focus on Quality Control and Compliance

Quality control and compliance are paramount concerns in the Manufacturing Analytics Market. As regulatory standards become more stringent, manufacturers are compelled to adopt analytics solutions that ensure product quality and compliance with industry regulations. Advanced analytics can help organizations monitor production quality in real-time, identify defects, and implement corrective actions promptly. The market for quality management software in manufacturing is projected to grow significantly, driven by the need for enhanced compliance and quality assurance. By investing in analytics-driven quality control systems, manufacturers can reduce waste, improve customer satisfaction, and mitigate risks associated with non-compliance. This focus on quality and compliance is likely to propel the Manufacturing Analytics Market forward, as organizations seek to maintain high standards in an increasingly competitive environment.