Expansion of IoT Devices

The proliferation of Internet of Things (IoT) devices is reshaping the landscape of the Global Managed Network Services Market Industry. As more devices connect to networks, the complexity of managing these connections increases, necessitating specialized managed services. Organizations are turning to managed network solutions to ensure reliable connectivity, data management, and security for their IoT ecosystems. This trend is likely to drive market growth as businesses seek to harness the potential of IoT while mitigating associated risks. The integration of IoT with managed services is expected to enhance operational capabilities and foster innovation across various sectors.

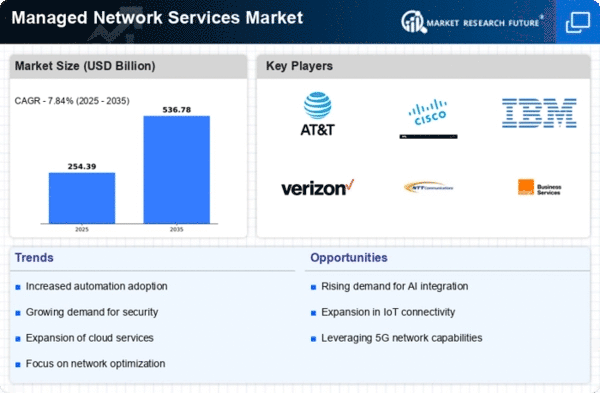

Market Growth Projections

The Global Managed Network Services Market Industry is poised for substantial growth, with projections indicating a market size of 235.94 USD Billion in 2024 and an expected increase to 541.32 USD Billion by 2035. This growth trajectory, characterized by a compound annual growth rate of 7.84% from 2025 to 2035, underscores the increasing reliance on managed services across various sectors. Factors such as the rise of cloud computing, cybersecurity concerns, and the expansion of IoT devices contribute to this upward trend. The market's evolution reflects the dynamic nature of technology and the growing need for efficient network management solutions.

Emergence of 5G Technology

The rollout of 5G technology is a transformative factor in the Global Managed Network Services Market Industry. With its promise of faster speeds and lower latency, 5G is set to revolutionize network management and connectivity. Businesses are increasingly adopting managed services to leverage the capabilities of 5G, enabling them to enhance their operational efficiency and customer experiences. The anticipated growth in the market, projected to reach 541.32 USD Billion by 2035, reflects the potential impact of 5G on network services. As organizations adapt to this new technology, the demand for managed network solutions is likely to surge.

Rising Cybersecurity Concerns

Cybersecurity threats pose a substantial challenge for businesses globally, driving the demand for managed network services. The Global Managed Network Services Market Industry is increasingly influenced by the need for enhanced security measures to protect sensitive data and maintain compliance with regulations. Organizations are investing in managed services that offer advanced security protocols, including threat detection and response capabilities. This trend indicates a proactive approach to cybersecurity, as companies recognize the potential financial and reputational risks associated with data breaches. The emphasis on security is likely to sustain market growth as businesses prioritize safeguarding their networks.

Growing Demand for Cloud Services

The increasing adoption of cloud services is a pivotal driver in the Global Managed Network Services Market Industry. As organizations migrate to cloud-based solutions, they require robust network management to ensure seamless connectivity and performance. This trend is evidenced by the projected market size of 235.94 USD Billion in 2024, reflecting a significant shift towards cloud infrastructure. Companies are seeking managed services to optimize their networks, enhance security, and reduce operational costs. The integration of cloud services with managed network solutions is likely to enhance service delivery and customer satisfaction, thereby propelling market growth.

Increased Focus on Operational Efficiency

Organizations are continuously striving for operational efficiency, which significantly influences the Global Managed Network Services Market Industry. By outsourcing network management, companies can focus on their core competencies while leveraging the expertise of managed service providers. This shift not only reduces operational costs but also enhances service quality and reliability. As businesses seek to streamline their operations, the demand for managed network services is expected to rise. The anticipated compound annual growth rate of 7.84% from 2025 to 2035 underscores the growing recognition of the benefits associated with outsourcing network management.