Emphasis on Network Security Solutions

The Managed Industrial Ethernet Switches Market is significantly impacted by the growing emphasis on network security solutions. With the rise in cyber threats targeting industrial networks, organizations are prioritizing the implementation of secure networking solutions. Managed switches offer advanced security features, such as VLANs and access control lists, which are crucial for protecting sensitive data. The market for industrial cybersecurity is projected to witness substantial growth, with investments expected to reach billions in the near future. This heightened focus on security is likely to drive the adoption of managed industrial Ethernet switches, as they provide essential tools for safeguarding industrial networks.

Expansion of Industrial IoT Applications

The Managed Industrial Ethernet Switches Market is poised for growth due to the expansion of Industrial Internet of Things (IIoT) applications. As industries increasingly adopt IIoT solutions, the need for reliable and secure networking infrastructure becomes essential. Managed switches provide the necessary connectivity and management capabilities to support a multitude of IIoT devices. Recent data indicates that the IIoT market is expected to grow at a CAGR of around 25% over the next few years, highlighting the increasing reliance on connected devices. This trend underscores the importance of managed industrial Ethernet switches in facilitating effective communication and data management within industrial environments.

Need for Enhanced Data Transmission Speeds

The Managed Industrial Ethernet Switches Market is driven by the increasing need for enhanced data transmission speeds in industrial applications. As industries evolve and require faster communication between devices, managed switches are becoming indispensable. These switches support high-speed data transfer, which is essential for applications such as real-time monitoring and control systems. Recent market analyses suggest that the demand for high-speed networking solutions is on the rise, with projections indicating a growth rate of over 15% in the coming years. This demand for speed and efficiency is likely to bolster the managed industrial Ethernet switches market, as organizations seek to optimize their operations.

Rising Demand for Automation in Industries

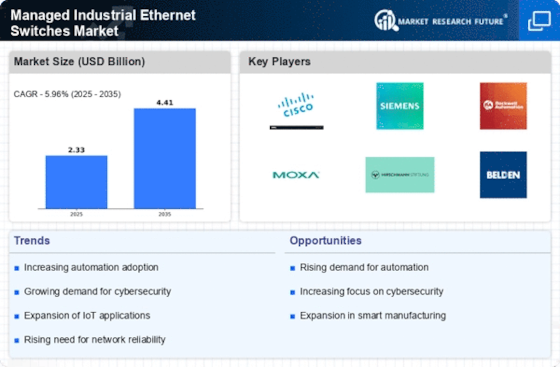

The Managed Industrial Ethernet Switches Market is experiencing a notable surge in demand due to the increasing automation across various sectors. Industries such as manufacturing, oil and gas, and transportation are increasingly adopting automated systems to enhance operational efficiency. This trend is driven by the need for real-time data processing and communication, which managed switches facilitate effectively. According to recent estimates, the automation market is projected to grow significantly, with a compound annual growth rate (CAGR) of over 10% in the coming years. As industries seek to integrate advanced technologies, the reliance on managed industrial Ethernet switches becomes paramount, thereby propelling market growth.

Integration of Smart Manufacturing Practices

The Managed Industrial Ethernet Switches Market is significantly influenced by the integration of smart manufacturing practices. As industries transition towards Industry 4.0, the need for robust networking solutions becomes critical. Managed switches play a vital role in connecting various devices and systems, ensuring seamless communication and data exchange. The market for smart manufacturing is anticipated to reach substantial figures, with investments in smart technologies expected to exceed billions in the next few years. This shift towards interconnected systems necessitates the deployment of managed industrial Ethernet switches, thereby driving their demand and adoption across multiple sectors.