Rising Demand for Automation

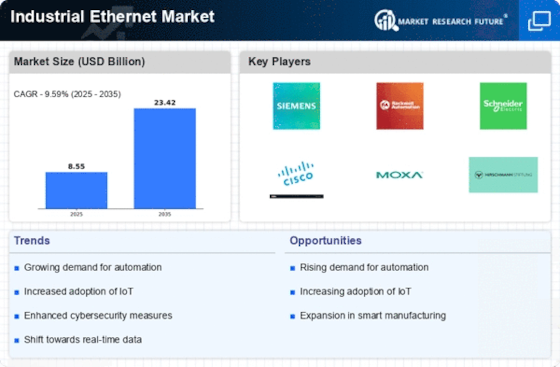

The Industrial Ethernet Market is experiencing a notable surge in demand for automation solutions across various sectors. As industries strive for enhanced efficiency and productivity, the integration of Industrial Ethernet Market technologies becomes increasingly vital. Automation facilitates real-time data exchange and control, which is essential for modern manufacturing processes. According to recent data, the automation sector is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is likely to drive the adoption of Industrial Ethernet Market solutions, as they provide the necessary infrastructure for seamless communication between devices and systems. Consequently, the need for reliable and high-speed connectivity solutions is becoming paramount, positioning Industrial Ethernet Market as a key enabler of automation initiatives.

Integration of Edge Computing

The Industrial Ethernet Market is being propelled by the integration of edge computing technologies. As industries seek to process data closer to the source, the need for reliable and high-speed communication networks becomes increasingly apparent. Edge computing allows for real-time data analysis and decision-making, which is essential for optimizing operations. Industrial Ethernet Market solutions are well-suited to support edge computing architectures, providing the necessary bandwidth and low latency required for effective data transmission. Recent analyses suggest that the edge computing market is expected to grow significantly, potentially reaching USD 100 billion by 2027. This growth indicates a strong correlation with the Industrial Ethernet Market, as the latter provides the foundational infrastructure for edge computing applications, thereby enhancing overall operational efficiency.

Expansion of Smart Manufacturing

The Industrial Ethernet Market is significantly influenced by the expansion of smart manufacturing practices. As industries increasingly adopt smart technologies, the demand for robust communication networks becomes critical. Smart manufacturing relies on interconnected devices and systems that require high-speed data transfer and low latency, characteristics inherent to Industrial Ethernet Market solutions. Recent statistics indicate that the smart manufacturing market is expected to reach USD 500 billion by 2026, highlighting the potential for Industrial Ethernet Market technologies to play a pivotal role in this transformation. The integration of Industrial Ethernet Market not only enhances operational efficiency but also supports advanced analytics and real-time monitoring, which are essential for optimizing production processes. This trend suggests a promising future for the Industrial Ethernet Market as it aligns with the broader shift towards intelligent manufacturing.

Increased Focus on Data Security

The Industrial Ethernet Market is witnessing an increased focus on data security as industries become more interconnected. With the rise of cyber threats, organizations are prioritizing the implementation of secure communication protocols within their networks. Industrial Ethernet Market solutions are evolving to incorporate advanced security features, such as encryption and authentication, to safeguard sensitive data. Recent reports indicate that the cybersecurity market for industrial applications is projected to grow at a CAGR of 12% through 2025. This growth underscores the necessity for secure Industrial Ethernet Market infrastructures that can withstand potential cyberattacks. As industries recognize the importance of protecting their operational technology, the demand for secure Industrial Ethernet Market solutions is likely to rise, further driving market growth.

Growing Need for Interoperability

The Industrial Ethernet Market is experiencing a growing need for interoperability among various devices and systems. As industries adopt diverse technologies, the ability to ensure seamless communication between different platforms becomes crucial. Industrial Ethernet Market solutions are designed to facilitate interoperability, allowing for the integration of legacy systems with modern technologies. This capability is essential for industries aiming to enhance their operational efficiency and reduce downtime. Recent data suggests that the market for interoperability solutions is expected to expand, driven by the increasing complexity of industrial environments. The emphasis on interoperability not only supports the integration of various devices but also enhances data sharing and collaboration across different systems. This trend is likely to bolster the Industrial Ethernet Market as organizations seek solutions that can bridge the gap between disparate technologies.