Increased Focus on Natural Ingredients

In Malaysia, the flavored water market is witnessing a shift towards products that emphasize natural ingredients. Consumers are increasingly scrutinizing labels, favoring beverages that contain no artificial additives or preservatives. This trend aligns with a broader movement towards clean eating and transparency in food and beverage production. The flavored water market is responding by introducing products that highlight natural flavors derived from fruits, herbs, and botanicals. Market Research Future suggests that approximately 60% of consumers express a preference for flavored waters made with organic ingredients. This inclination towards natural options not only enhances the appeal of flavored water but also positions the industry favorably in a competitive landscape where health and wellness are paramount.

Rising Demand for Hydration Alternatives

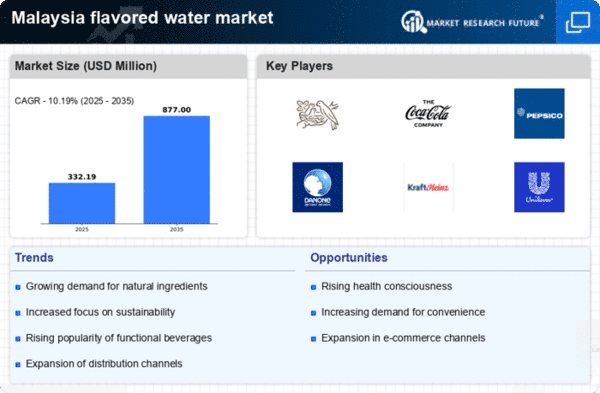

The flavored water market in Malaysia experiences a notable increase in demand as consumers seek healthier hydration alternatives. With a growing awareness of the adverse effects of sugary beverages, many individuals are shifting towards flavored water as a refreshing option. This trend is particularly pronounced among younger demographics, who are more inclined to explore innovative beverage choices. Market data indicates that flavored water sales have surged by approximately 15% in the past year, reflecting a significant shift in consumer preferences. The flavored water market is thus positioned to capitalize on this trend, offering a diverse range of flavors that cater to various taste preferences. As health consciousness continues to rise, the industry is likely to see sustained growth, driven by the desire for low-calorie, flavorful hydration solutions.

Growing Popularity of Functional Beverages

The flavored water market in Malaysia is increasingly influenced by the rising popularity of functional beverages. Consumers are seeking drinks that offer additional health benefits beyond hydration, such as enhanced energy, improved digestion, or immune support. This trend is reflected in the introduction of flavored waters infused with vitamins, minerals, and probiotics. The flavored water market is adapting to this demand by developing products that cater to health-conscious consumers looking for multifunctional beverages. Recent data indicates that functional flavored waters have seen a growth rate of around 20% in the past year, suggesting a robust market potential. As consumers continue to prioritize health and wellness, the industry is likely to expand its offerings to include more functional options.

Expansion of Retail Channels and E-commerce

The flavored water market in Malaysia benefits from the expansion of retail channels and the growth of e-commerce platforms. As consumers increasingly turn to online shopping for convenience, the availability of flavored water products through various digital platforms has surged. This shift allows consumers to access a wider range of options, including niche and premium brands that may not be available in traditional retail outlets. The flavored water market is capitalizing on this trend by enhancing its online presence and engaging in targeted marketing strategies. Recent statistics indicate that online sales of flavored water have increased by approximately 25% over the past year, highlighting the importance of e-commerce in driving market growth. This trend is expected to continue, as more consumers embrace the convenience of online shopping.

Innovative Marketing Strategies and Branding

In Malaysia, the flavored water market is increasingly characterized by innovative marketing strategies and branding efforts. Companies are leveraging social media and influencer partnerships to reach younger audiences, creating engaging content that resonates with health-conscious consumers. The flavored water market is also focusing on unique packaging designs and branding narratives that emphasize lifestyle and wellness. This approach not only attracts attention but also fosters brand loyalty among consumers. Market analysis suggests that brands employing innovative marketing tactics have experienced a sales increase of around 30% in the past year. As competition intensifies, the ability to effectively communicate brand values and connect with consumers will be crucial for success in the flavored water market.