Technological Advancements in MRI Robotics

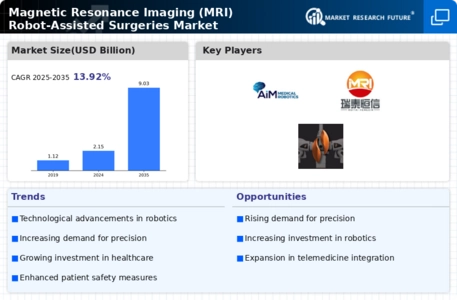

The Magnetic Resonance Imaging (MRI) Robot-Assisted Surgeries Market is experiencing a surge in technological advancements that enhance surgical precision and patient outcomes. Innovations such as real-time imaging and advanced robotic systems are transforming traditional surgical practices. For instance, the integration of artificial intelligence in MRI robotics allows for improved image analysis and decision-making during surgeries. According to recent data, the market for MRI robotics is projected to grow at a compound annual growth rate of over 15% in the coming years, driven by these technological innovations. Furthermore, the development of hybrid systems that combine MRI with other imaging modalities is likely to expand the capabilities of robot-assisted surgeries, making them more versatile and effective.

Growing Awareness of Advanced Surgical Options

The growing awareness of advanced surgical options is significantly impacting the Magnetic Resonance Imaging (MRI) Robot-Assisted Surgeries Market. As patients become more informed about their treatment choices, there is a noticeable shift towards seeking out innovative surgical techniques that offer better outcomes. Educational initiatives and marketing efforts by healthcare providers are contributing to this awareness, highlighting the benefits of MRI robot-assisted surgeries. Data suggests that patient inquiries about robotic-assisted procedures have increased, reflecting a broader trend towards embracing technology in healthcare. This heightened awareness is likely to drive demand for MRI robotics, as patients actively seek out facilities that offer these advanced surgical options.

Rising Demand for Minimally Invasive Procedures

The demand for minimally invasive procedures is a key driver in the Magnetic Resonance Imaging (MRI) Robot-Assisted Surgeries Market. Patients increasingly prefer surgeries that promise reduced recovery times, less pain, and minimal scarring. MRI robot-assisted surgeries align perfectly with this trend, offering enhanced precision while minimizing tissue damage. Market data indicates that minimally invasive surgeries are expected to account for a significant portion of the surgical market, with MRI-guided techniques gaining traction. This shift towards less invasive options is likely to propel the adoption of MRI robotics, as healthcare providers seek to meet patient expectations and improve surgical outcomes. As a result, the market for MRI robot-assisted surgeries is poised for substantial growth.

Increased Investment in Healthcare Infrastructure

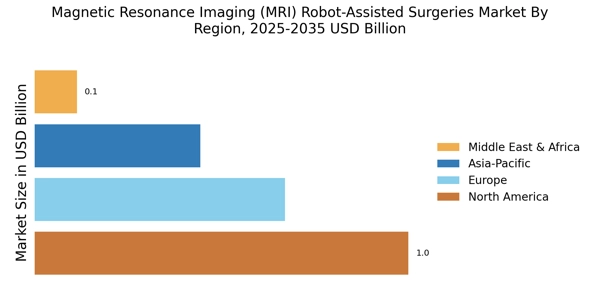

Investment in healthcare infrastructure is a crucial factor influencing the Magnetic Resonance Imaging (MRI) Robot-Assisted Surgeries Market. Governments and private entities are allocating substantial resources to enhance healthcare facilities, particularly in developing regions. This investment often includes the acquisition of advanced medical technologies, such as MRI robotics, to improve surgical capabilities. Recent reports suggest that healthcare spending is on the rise, with a focus on integrating cutting-edge technologies into surgical practices. As healthcare systems evolve, the demand for MRI robot-assisted surgeries is likely to increase, driven by the need for improved patient care and operational efficiency. This trend indicates a promising future for the MRI robotics market.

Regulatory Support for Advanced Medical Technologies

Regulatory support for advanced medical technologies plays a pivotal role in shaping the Magnetic Resonance Imaging (MRI) Robot-Assisted Surgeries Market. Regulatory bodies are increasingly recognizing the potential benefits of MRI robotics in enhancing surgical precision and patient safety. Streamlined approval processes for innovative medical devices are encouraging manufacturers to invest in research and development. Recent regulatory changes have facilitated faster market entry for new MRI robotic systems, which is likely to stimulate competition and innovation within the industry. As regulatory frameworks evolve to support advanced surgical technologies, the MRI robot-assisted surgeries market is expected to expand, providing healthcare providers with more options to improve patient care.