Expansion in Emerging Markets

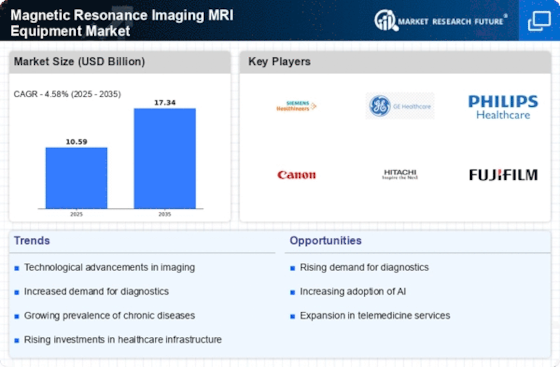

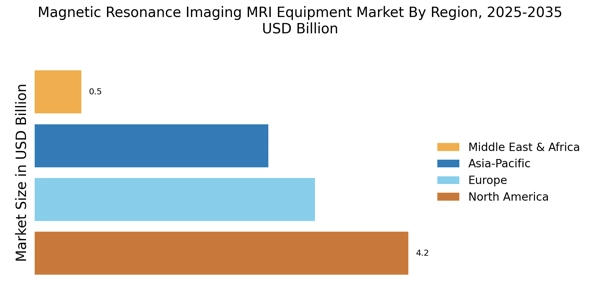

The Magnetic Resonance Imaging MRI Equipment Market is poised for growth due to the expansion of healthcare infrastructure in emerging markets. Countries with developing economies are increasingly investing in healthcare facilities, leading to a higher demand for advanced diagnostic tools, including MRI equipment. This trend is supported by government initiatives aimed at improving healthcare access and quality. Market analysis indicates that regions such as Asia-Pacific and Latin America are experiencing rapid growth in MRI installations, driven by rising healthcare expenditures and a growing awareness of the importance of early diagnosis. As these markets continue to develop, the demand for MRI equipment is expected to rise, presenting significant opportunities for manufacturers.

Aging Population and Chronic Diseases

The Magnetic Resonance Imaging MRI Equipment Market is significantly influenced by the aging population and the rising prevalence of chronic diseases. As the global population ages, the incidence of conditions requiring advanced imaging, such as neurological disorders and cancers, is increasing. This demographic shift is prompting healthcare providers to invest in MRI technology to enhance diagnostic capabilities. Data indicates that the demand for MRI scans is expected to rise in tandem with the aging population, as older individuals are more likely to require medical imaging services. Consequently, this trend is likely to drive the growth of the MRI equipment market, as healthcare systems adapt to meet the needs of an aging demographic.

Rising Demand for Non-Invasive Procedures

The Magnetic Resonance Imaging MRI Equipment Market is witnessing a notable increase in the demand for non-invasive diagnostic procedures. As healthcare providers and patients alike prioritize safety and comfort, MRI's non-invasive nature positions it as a preferred choice for various diagnostic applications. This trend is particularly evident in the fields of oncology and neurology, where accurate imaging is essential for treatment planning. Market data suggests that the demand for MRI scans has risen, reflecting a broader shift towards non-invasive techniques in medical diagnostics. This growing preference is likely to drive the expansion of the MRI equipment market, as healthcare facilities invest in advanced MRI technologies to meet patient needs.

Technological Advancements in MRI Equipment

The Magnetic Resonance Imaging MRI Equipment Market is experiencing a surge in technological advancements that enhance imaging capabilities. Innovations such as high-field MRI systems and functional MRI are becoming increasingly prevalent. These advancements allow for improved resolution and faster imaging times, which are crucial for accurate diagnostics. The integration of artificial intelligence in MRI technology is also noteworthy, as it aids in image analysis and interpretation, potentially reducing the workload on radiologists. According to recent data, the market for advanced MRI systems is projected to grow significantly, driven by the demand for high-quality imaging in clinical settings. This trend indicates a shift towards more sophisticated MRI equipment, which is likely to dominate the market in the coming years.

Increased Investment in Healthcare Infrastructure

The Magnetic Resonance Imaging MRI Equipment Market is benefiting from increased investment in healthcare infrastructure across various regions. Governments and private entities are recognizing the importance of advanced diagnostic tools in improving healthcare outcomes. This investment is leading to the establishment of new hospitals and diagnostic centers equipped with state-of-the-art MRI technology. Market data suggests that this trend is particularly pronounced in regions with growing populations and rising healthcare demands. As healthcare facilities expand and upgrade their equipment, the demand for MRI systems is likely to increase, further propelling the growth of the MRI equipment market. This investment trend indicates a commitment to enhancing diagnostic capabilities and patient care.