Expanding Use in Agriculture

The agricultural sector is increasingly recognizing the benefits of magnesium chloride as a soil amendment and nutrient source. This compound plays a crucial role in enhancing soil quality and promoting plant growth, which is vital for food production. The Global Magnesium Chloride Industry is experiencing growth as farmers adopt magnesium chloride to improve crop yields and soil health. Recent data indicates that the use of magnesium chloride in agriculture has increased by approximately 15% over the past few years, reflecting a broader trend towards sustainable farming practices. This shift is likely to continue, as agricultural stakeholders seek to optimize resource use and enhance productivity.

Growth in Industrial Applications

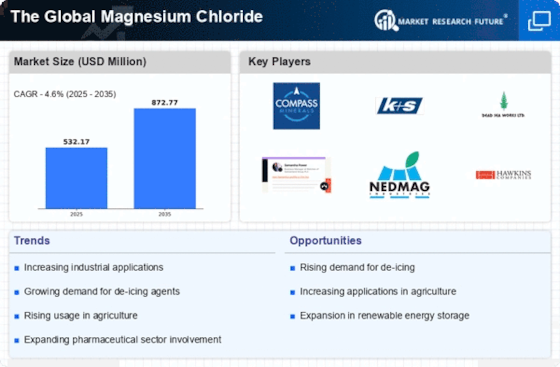

Industrial applications of magnesium chloride are expanding, particularly in sectors such as construction, textiles, and pharmaceuticals. This compound is utilized for its properties as a dust control agent, a binding agent, and a source of magnesium in various processes. The Global Magnesium Chloride Industry is poised for growth as industries increasingly recognize the versatility of magnesium chloride. Recent statistics suggest that the industrial segment has seen a compound annual growth rate of around 10% in recent years. This trend is expected to persist, driven by ongoing industrialization and the need for efficient materials in manufacturing processes.

Rising Demand in De-icing Applications

The demand for magnesium chloride in de-icing applications appears to be on the rise, particularly in regions with harsh winter climates. This compound is favored for its effectiveness in melting ice and snow while being less corrosive than traditional salt. The Global Magnesium Chloride Industry is likely to benefit from this trend, as municipalities and transportation authorities increasingly seek environmentally friendly alternatives. In recent years, the market for de-icing agents has expanded, with magnesium chloride accounting for a notable share. This growth is projected to continue, driven by the need for safer and more sustainable solutions in winter road maintenance.

Increasing Awareness of Health Benefits

There is a growing awareness of the health benefits associated with magnesium chloride, particularly in the wellness and dietary supplement sectors. This compound is known for its potential to support various bodily functions, including muscle and nerve function. The Global Magnesium Chloride Industry is likely to see increased demand as consumers become more health-conscious and seek natural supplements. Recent market analysis indicates that the dietary supplement segment has experienced a surge, with magnesium chloride products gaining popularity. This trend may continue as more individuals prioritize health and wellness in their lifestyles.

Regulatory Support for Sustainable Practices

Regulatory frameworks are increasingly supporting the use of environmentally friendly materials, including magnesium chloride. Governments and organizations are promoting sustainable practices across various industries, which is likely to benefit The Global Magnesium Chloride Industry. Recent policies aimed at reducing environmental impact have encouraged the adoption of magnesium chloride in applications such as de-icing and dust control. This regulatory support may lead to a more favorable market environment, fostering growth and innovation in the use of magnesium chloride. As sustainability becomes a priority, the market is expected to expand in response to these initiatives.