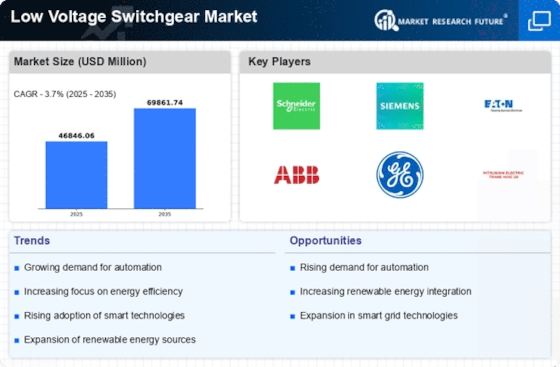

The competitive landscape of the Low Voltage Switchgear Market is influenced by several key players who offer products for various applications. Major players are focusing on digitalized power distribution to expand their Low Voltage Switchgear market share within the rapidly growing renewable energy sectors of Europe and Asia. The Low Voltage Switchgear Market share is increasingly being contested by manufacturers who specialize in high-reflectivity components that integrate seamlessly with advanced solar module technologies. Leading market participants, including Schneider Electric, General Electric, Hyosung Corporation, Hyundai Electric & Energy Systems Co, Ltd, Fuji Electric Co Ltd, among others. Siemens aims to strengthen the growth of its business segments through contracts, agreements, and mergers & acquisitions. Furthermore, its strong alliances with several large multinational companies in the global market enable it to accelerate its growth. The company is expanding its presence in the global market by providing software and related solutions and adding new technologies to its portfolio to capture new markets. It aims to enhance its product portfolio through innovation and investments, which will help the company take advantage of new opportunities in the energy management industry. ABB is focused on product development strategies to integrate automation in its industrial automation division. Moreover, its long-term growth strategy involves expanding its core business operations through acquisitions, ensuring its financial stability. The Low Voltage Switchgear Market comprises various global, regional, and local service providers that are continuously evolving to enhance their market position. Expansion of smart grid networks and integration of sustainable energy infrastructure are the key factors that aid market growth. The service providers compete based on cost, efficiency, and reliability of low voltage switchgears to stay relevant in the competitive market. Siemens.: Siemens is a global engineering and manufacturing company specializing in electrification, automation, digitalization, innovation, and technology. It provides automation and control, power, transportation, and medical diagnosis engineering solutions. The company offers various products and services in drive technology, energy, financing, healthcare, industrial automation, mobility, services, software, and consumer products sectors. It is the world's largest producer of energy-efficient and resource-saving technologies and a leading provider of power generation, transmission systems, and medical diagnostic equipment. Siemens has a global presence in about 200 countries worldwide and operates through 289 production houses, manufacturing facilities, and R&D centers. Eaton Corporation.: Eaton Corporation (Eaton) is a global power management company. It provides energy-efficient solutions for effectively managing electrical, hydraulic, and mechanical power systems efficiently, safely, and sustainably. The company operates through six business segments: electrical products, electrical systems and services, vehicles, hydraulics, aerospace, and e-mobility. It offers its products and solutions for applications in various industrial verticals, including aviation, data centers, food & beverage, healthcare, oil & gas, mining, metals & minerals, machine building, rail, utility, transportation, and government & military. The company offers a wide range of products and solutions, such as circuit breakers, fuses, solar switches, inverters, switch disconnectors, vacuum interrupters, distribution boards, switchgear, relays, busways, sensors, and power management solutions.