Growing Industrial Automation

The rise of industrial automation in the US is a significant driver for the low voltage-switchgear market. As industries increasingly adopt automated processes, the demand for reliable and efficient electrical distribution systems grows. Low voltage-switchgear is essential for managing power supply in automated environments, ensuring that machinery operates smoothly and efficiently. The industrial automation market is projected to reach $300 billion by 2026, indicating a robust growth trajectory. This expansion will likely necessitate the integration of advanced low voltage-switchgear solutions to support the increased energy demands of automated systems. Furthermore, the trend towards Industry 4.0, characterized by interconnected devices and smart manufacturing, will further enhance the relevance of low voltage-switchgear in modern industrial applications.

Increased Focus on Safety Standards

Safety regulations and standards are becoming increasingly stringent in the US, impacting the low voltage-switchgear market. The National Electrical Code (NEC) and other regulatory bodies are continuously updating safety requirements for electrical installations. This focus on safety is driving manufacturers to innovate and enhance the safety features of their low voltage-switchgear products. As a result, companies are investing in research and development to comply with these regulations, which may lead to the introduction of safer and more reliable switchgear solutions. The emphasis on safety not only protects end-users but also fosters consumer confidence in electrical systems. Consequently, the low voltage-switchgear market is likely to experience growth as manufacturers align their products with evolving safety standards.

Rising Demand for Renewable Energy Sources

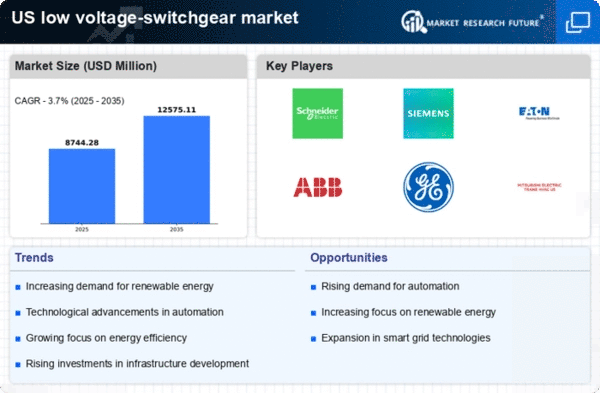

The transition towards renewable energy sources in the US is driving the low voltage-switchgear market. As more solar and wind energy projects are developed, the need for efficient power distribution systems becomes paramount. Low voltage-switchgear plays a crucial role in managing the distribution of electricity generated from these renewable sources. According to recent data, the renewable energy sector is expected to grow at a CAGR of approximately 10% over the next five years, which will likely increase the demand for low voltage-switchgear solutions. This shift not only supports sustainability goals but also necessitates advanced switchgear technologies to ensure reliability and safety in power distribution. Consequently, the low voltage-switchgear market is poised to benefit significantly from this trend, as utilities and developers seek to integrate these systems into their infrastructure.

Urbanization and Infrastructure Development

The ongoing urbanization in the US is a key driver for the low voltage-switchgear market. As cities expand and new infrastructure projects emerge, the demand for reliable electrical distribution systems increases. Urban areas require robust low voltage-switchgear to support residential, commercial, and industrial developments. The US is projected to invest over $1 trillion in infrastructure improvements over the next decade, which includes upgrades to electrical systems. This investment is likely to enhance the adoption of low voltage-switchgear technologies, ensuring that they meet the growing energy demands of urban populations. Furthermore, the integration of smart grid technologies into urban infrastructure will further propel the low voltage-switchgear market, as these systems are essential for efficient energy management and distribution.

Technological Advancements in Electrical Equipment

Technological innovations in electrical equipment are significantly influencing the low voltage-switchgear market. The introduction of digital switchgear, which offers enhanced monitoring and control capabilities, is transforming how electrical systems operate. These advancements allow for real-time data analysis and improved fault detection, which can lead to reduced downtime and maintenance costs. The market for digital switchgear is expected to grow substantially, with estimates suggesting a CAGR of around 8% over the next five years. As industries increasingly adopt automation and smart technologies, the demand for advanced low voltage-switchgear solutions will likely rise. This trend indicates a shift towards more intelligent electrical systems, which are essential for optimizing energy efficiency and reliability in various applications.