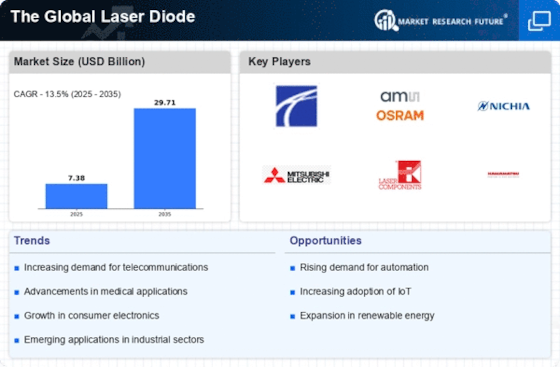

Growth in Consumer Electronics

The consumer electronics sector is witnessing a robust growth trajectory, which is likely to propel The Global Laser Diode Industry forward. Laser diodes are increasingly utilized in various consumer devices, including laser printers, optical disc players, and high-definition televisions. The proliferation of smart devices and the increasing consumer preference for high-quality audio-visual experiences are driving the demand for laser diodes. Market data suggests that the consumer electronics segment could represent approximately 25% of the overall market by 2026. This growth is indicative of a broader trend towards miniaturization and enhanced performance in electronic devices, where laser diodes play a pivotal role. As such, the expansion of the consumer electronics market is a significant driver for The Global Laser Diode Industry.

Advancements in Medical Technology

The medical technology sector is increasingly adopting laser diodes for various applications, including surgical procedures, diagnostics, and therapeutic treatments. The precision and efficiency offered by laser diodes make them indispensable in modern medical devices. The Global Laser Diode Industry is likely to see substantial growth as healthcare providers continue to integrate advanced laser technologies into their practices. Recent market analyses indicate that the medical segment could account for around 20% of the total market share by 2026. This growth is driven by the rising prevalence of chronic diseases and the demand for minimally invasive procedures, which rely heavily on laser technology. Therefore, advancements in medical technology represent a crucial driver for The Global Laser Diode Industry.

Rising Demand in Telecommunications

The telecommunications sector is experiencing a notable surge in demand for laser diodes, primarily driven by the increasing need for high-speed data transmission. Laser diodes are integral to fiber optic communication systems, which are essential for modern telecommunication networks. As the demand for bandwidth continues to escalate, The Global Laser Diode Industry is poised to benefit significantly. According to recent estimates, the telecommunications segment is projected to account for a substantial share of the market, potentially exceeding 30% by 2026. This growth is further fueled by the expansion of 5G networks, which require advanced laser diode technology to enhance signal quality and transmission speeds. Consequently, the rising demand in telecommunications is a critical driver for The Global Laser Diode Industry.

Emerging Applications in Industrial Automation

The industrial automation sector is increasingly leveraging laser diodes for various applications, including material processing, laser marking, and sensing technologies. The efficiency and precision of laser diodes make them ideal for enhancing productivity in manufacturing processes. The Global Laser Diode Industry is expected to benefit from this trend, as industries seek to optimize operations and reduce costs. Market projections suggest that the industrial automation segment could contribute approximately 15% to the overall market by 2026. This growth is indicative of a broader shift towards automation and smart manufacturing, where laser diodes play a vital role in improving operational efficiency. Thus, emerging applications in industrial automation serve as a significant driver for The Global Laser Diode Industry.

Increased Investment in Research and Development

Investment in research and development within the laser diode sector is on the rise, fostering innovation and the development of new technologies. Companies are increasingly focusing on enhancing the performance and efficiency of laser diodes, which is likely to drive The Global Laser Diode Industry forward. This trend is supported by government initiatives aimed at promoting technological advancements and sustainable practices. Recent data indicates that R&D spending in the laser technology sector could increase by over 10% annually through 2026. This influx of investment is expected to lead to the introduction of next-generation laser diodes with improved capabilities, thereby expanding their applications across various industries. Consequently, increased investment in research and development is a pivotal driver for The Global Laser Diode Industry.