Advancements in IoT Technology

The rapid advancements in Internet of Things (IoT) technology are propelling the Location of Things Market forward. Enhanced connectivity and the proliferation of smart devices enable real-time location tracking and data collection. According to recent data, the number of connected devices is projected to reach 75 billion by 2025, which underscores the growing reliance on IoT solutions. This surge in connected devices facilitates improved asset management, logistics, and supply chain operations, thereby driving demand for location-based services. As businesses increasingly adopt IoT technologies, the Location of Things Market is likely to experience substantial growth, as organizations seek to leverage location data for operational efficiency and strategic decision-making.

Rise of Location-Based Services

The increasing adoption of location-based services (LBS) is a key driver for the Location of Things Market. Businesses across various sectors, including retail, transportation, and healthcare, are utilizing LBS to enhance customer experiences and optimize operations. For instance, the retail sector is leveraging geolocation data to provide personalized marketing and improve inventory management. Market data indicates that the LBS market is expected to grow significantly, with a projected value of over 100 billion by 2026. This growth is indicative of the rising importance of location data in driving business strategies and improving service delivery, thereby reinforcing the relevance of the Location of Things Market.

Growing Importance of Geospatial Analytics

The growing importance of geospatial analytics is a crucial driver for the Location of Things Market. Organizations are increasingly recognizing the value of spatial data in making informed decisions. Geospatial analytics enables businesses to visualize and analyze location data, leading to enhanced insights and strategic planning. The market for geospatial analytics is projected to reach over 100 billion by 2025, reflecting its rising significance across various industries, including real estate, agriculture, and environmental management. As companies continue to harness the power of location intelligence, the Location of Things Market is likely to expand, driven by the demand for advanced analytical tools and solutions.

Emergence of Smart Transportation Solutions

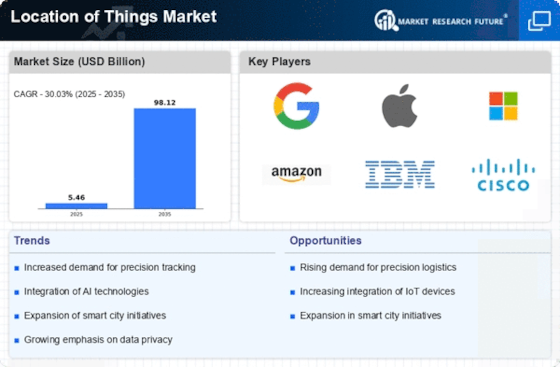

The emergence of smart transportation solutions is transforming the Location of Things Market. With the integration of location data, transportation systems are becoming more efficient and responsive. Technologies such as GPS and real-time traffic monitoring are enabling better route planning and reducing congestion. The Location of Things Market is anticipated to reach approximately 200 billion by 2025, highlighting the increasing investment in location-based technologies. This trend is likely to enhance the safety and efficiency of transportation networks, making location data indispensable for urban planning and infrastructure development. Consequently, the Location of Things Market stands to benefit from the growing demand for smart transportation solutions.

Increased Demand for Fleet Management Solutions

The rising demand for fleet management solutions is significantly influencing the Location of Things Market. Companies are increasingly adopting telematics and GPS tracking systems to monitor vehicle locations, optimize routes, and reduce operational costs. Market Research Future suggests that the fleet management market is expected to grow at a compound annual growth rate of over 15% through 2025. This growth is driven by the need for improved efficiency and accountability in logistics and transportation sectors. As businesses seek to enhance their fleet operations, the reliance on location data becomes paramount, thereby propelling the Location of Things Market forward.