Increased Investment in Smart Infrastructure

Investment in smart infrastructure is a key driver for the location of-things market, as cities and municipalities across the US are increasingly adopting smart technologies to improve urban living. This trend is reflected in the allocation of funds for smart city projects, which often incorporate location-based services to enhance public safety, traffic management, and resource allocation. Recent reports indicate that US cities are projected to invest over $100 billion in smart infrastructure by 2027. This influx of capital is likely to stimulate the location of-things market, as it encourages the development of innovative solutions that integrate seamlessly with existing urban frameworks, ultimately enhancing the quality of life for residents.

Growing Emphasis on Supply Chain Optimization

The location of-things market is being propelled by a growing emphasis on supply chain optimization among businesses in the US. Companies are increasingly recognizing the value of location data in streamlining operations, reducing costs, and improving service delivery. The integration of location-based technologies allows organizations to track assets in real-time, manage inventory more effectively, and enhance logistics planning. As of November 2025, it is estimated that businesses utilizing location-based solutions for supply chain management could see efficiency improvements of up to 30%. This trend underscores the critical role that location data plays in driving operational excellence, thereby fostering growth within the location of-things market.

Rising Demand for Real-Time Location Services

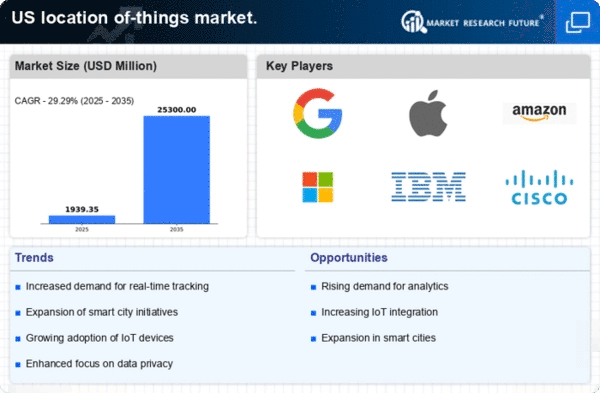

The location of-things market is experiencing a notable surge in demand for real-time location services, driven by the increasing need for businesses to enhance operational efficiency. Industries such as logistics, retail, and healthcare are leveraging these services to optimize supply chain management and improve customer experiences. According to recent data, the market for real-time location services in the US is projected to grow at a CAGR of approximately 25% over the next five years. This growth is indicative of a broader trend where organizations are prioritizing location-based insights to make informed decisions. As companies seek to harness the power of location data, the location of-things market is likely to expand, providing innovative solutions that cater to diverse industry needs.

Advancements in Wireless Communication Technologies

The evolution of wireless communication technologies is significantly impacting the location of-things market. Innovations such as 5G networks are enabling faster and more reliable data transmission, which is crucial for location-based applications. The enhanced bandwidth and reduced latency associated with 5G are expected to facilitate the deployment of advanced location services across various sectors, including transportation and smart infrastructure. As of November 2025, it is estimated that 5G adoption in the US will reach approximately 60%, further driving the demand for location-based solutions. This technological advancement not only enhances user experiences but also opens new avenues for businesses to leverage location data effectively, thereby propelling the growth of the location of-things market.

Rising Consumer Expectations for Personalized Experiences

Consumer expectations for personalized experiences are shaping the landscape of the location of-things market. As individuals increasingly seek tailored services, businesses are leveraging location data to deliver customized offerings that resonate with their target audiences. This trend is particularly evident in sectors such as retail and hospitality, where location-based marketing strategies are becoming more prevalent. Data suggests that approximately 70% of consumers are more likely to engage with brands that provide personalized experiences based on their location. Consequently, businesses are investing in location technologies to meet these expectations, driving the expansion of the location of-things market as they strive to enhance customer satisfaction and loyalty.