Top Industry Leaders in the Liquid Polybutadiene Market

The LPBD market is poised for continued growth, driven by rising demand from diverse end-use applications and increasing focus on sustainability. Understanding the competitive landscape, key strategies, and evolving market dynamics will be crucial for players to navigate this dynamic environment and claim their share of this promising market.

Competitive Strategies:

-

Product Differentiation: Companies like Kuraray, SIBUR International, Idemitsu Kosan, and Versalis are focusing on developing customized LPBD grades with varying viscosity, purity, and functionality to cater to specific end-use applications. This caters to diverse customer needs and helps in securing market share. -

Vertical Integration: Leading players are integrating backward to secure raw materials and control production costs. For instance, Idemitsu Kosan acquired butadiene producers to ensure a stable supply chain. Such moves provide a competitive edge and cost advantage. -

Geographical Expansion: Established players like Evonik Industries and Cray Valley are actively expanding into emerging markets like China and India, fueled by the rapid growth of automotive and tire industries in these regions. This geographically diversified presence helps tap into new consumer bases and drive market share. -

Technological Innovation: Continuous research and development are crucial for staying ahead in the LPBD market. Companies like Nippon Soda are investing in novel production processes and catalysts to improve LPBD properties and reduce environmental impact. This leads to product differentiation and attracts environmentally conscious customers.

Factors Influencing Market Share:

-

Quality and Price: Customers often prioritize a balance between product quality and competitive pricing. High-quality LPBD at competitive prices can significantly sway market share towards specific players. -

Brand Reputation: Established brands like Kuraray and SIBUR with a strong track record of reliability and performance tend to hold a stronger market position. Building brand trust through consistent quality and customer service is key. -

Distribution Network: A robust distribution network ensures efficient delivery and timely product availability. Companies like Versalis are investing in logistics infrastructure to expand their reach and cater to a wider customer base. -

Government Regulations: Stringent environmental regulations, particularly in Europe and North America, are pushing manufacturers towards developing sustainable LPBD production processes. Compliance with regulations can be a market differentiator and attract eco-conscious buyers.

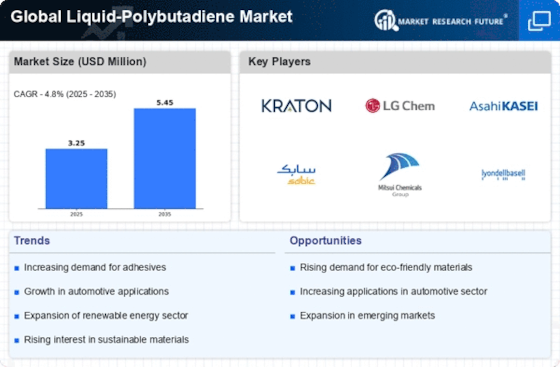

The key market players are as follows:

- Cray Valley

- Kuraray Co. Ltd.

- Evonik Industries AG

- SIBUR International GmbH

- Nippon Soda Co. Ltd.

- Reliance Industries Limited

- Synthomer plc

- Versalis S.p.A.

- Uber Industries

Recent Developments:

-

October 2023: Versalis successfully starts up a new LPBD production line in Italy, increasing its capacity by 20%. -

November 2023: Evonik Industries launches a new LPBD grade specifically designed for high-performance adhesives, targeting the automotive and construction sectors. -

December 2023: A consortium of leading LPBD producers forms a joint venture to develop and commercialize next-generation LPBD grades with enhanced functionalities.