Light Therapy Market Summary

As per Market Research Future analysis, The Global Light Therapy Market Size was estimated at 1.03 USD Billion in 2024. The light therapy therapeutics industry is projected to grow from 1.085 USD Billion in 2025 to 1.824 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.3% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Global Light Therapy Market is experiencing robust growth driven by technological advancements and increasing awareness of its benefits.

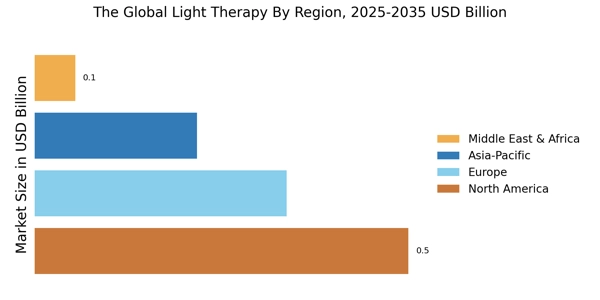

- North America remains the largest market for light therapy, driven by a growing focus on mental health solutions.

- The Asia-Pacific region is emerging as the fastest-growing market, reflecting a rising demand for innovative wellness products.

- Light boxes dominate the market, while floor and desk lamps are witnessing the fastest growth due to their versatility and convenience.

- Key market drivers include the increasing awareness of light therapy benefits and its integration into wellness programs.

Market Size & Forecast

| 2024 Market Size | 1.03 (USD Billion) |

| 2035 Market Size | 1.824 (USD Billion) |

| CAGR (2025 - 2035) | 5.33% |

Major Players

Philips (NL), Verilux (US), Northern Light Technology (CA), Sunlighten (US), LightStim (US), Tend (US), Aura Daylight (US), Luminette (BE), Bioptron (CH)