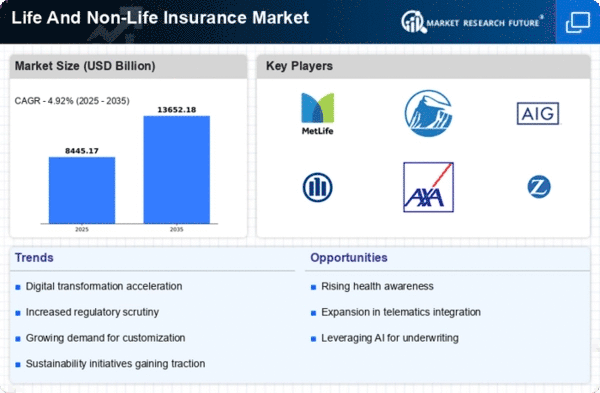

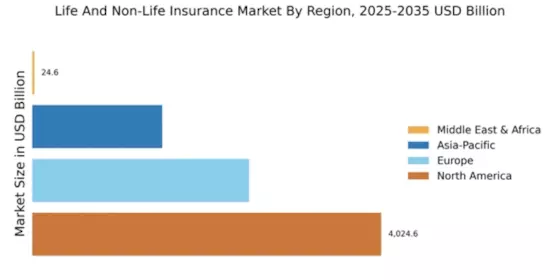

North America : Market Leader in Insurance

North America continues to lead the Life and Non-Life Insurance market, holding a significant share of 4024.58 million in 2024. The region's growth is driven by a robust economy, increasing consumer awareness, and favorable regulatory frameworks. Demand for innovative insurance products, particularly in health and life sectors, is on the rise, supported by technological advancements and digital transformation in service delivery. Regulatory bodies are also enhancing consumer protection, further boosting market confidence.

The competitive landscape is characterized by major players such as MetLife, Prudential, and AIG, which dominate the market with their extensive product offerings and strong distribution networks. Canada and the US are the leading countries, contributing significantly to the regional market size. The presence of established firms and a growing number of startups focusing on niche markets are reshaping the industry dynamics, ensuring sustained growth and innovation.

Europe : Emerging Insurance Hub

Europe's Life and Non-Life Insurance market is projected to reach 2500.0 million by 2025, driven by increasing demand for comprehensive insurance solutions and regulatory support. The region benefits from a diverse economic landscape, with varying insurance needs across countries. Regulatory initiatives aimed at enhancing consumer protection and promoting transparency are catalyzing market growth. The rise of digital platforms is also transforming how insurance products are marketed and sold, making them more accessible to consumers.

Leading countries such as Germany, France, and the UK are at the forefront of this growth, with key players like Allianz, AXA, and Zurich Insurance Group dominating the market. The competitive landscape is marked by innovation, with companies investing in technology to improve customer experience and streamline operations. The presence of a well-established regulatory framework further supports the market's expansion, ensuring stability and trust among consumers.

Asia-Pacific : Rapidly Growing Insurance Market

The Asia-Pacific Life and Non-Life Insurance market is expected to grow significantly, reaching 1500.0 million by 2025. This growth is fueled by rising disposable incomes, increasing awareness of insurance products, and a growing middle class. Regulatory reforms aimed at enhancing market accessibility and consumer protection are also playing a crucial role in this expansion. The region is witnessing a shift towards digital insurance solutions, making it easier for consumers to access various products and services.

Countries like China, India, and Japan are leading the charge, with a mix of local and international players competing for market share. Key players such as Manulife and Sun Life Financial are expanding their footprints in the region, focusing on tailored products to meet diverse consumer needs. The competitive landscape is dynamic, with a focus on innovation and customer-centric solutions, ensuring that the market remains vibrant and responsive to changing demands.

Middle East and Africa : Untapped Insurance Potential

The Middle East and Africa (MEA) insurance market, though currently valued at only 24.57 million, presents significant growth opportunities. The region is characterized by a young population and increasing economic diversification, which are driving demand for both Life and Non-Life insurance products. Regulatory bodies are beginning to implement reforms aimed at enhancing market transparency and consumer protection, which are essential for building trust in insurance products. The growing awareness of risk management is also contributing to market growth.

Countries like South Africa and the UAE are leading the market, with a mix of local and international insurers vying for a share. The presence of key players such as Chubb and Generali is helping to shape the competitive landscape. As the region continues to develop, the insurance sector is expected to evolve, with a focus on innovative products and services tailored to meet the unique needs of the population.