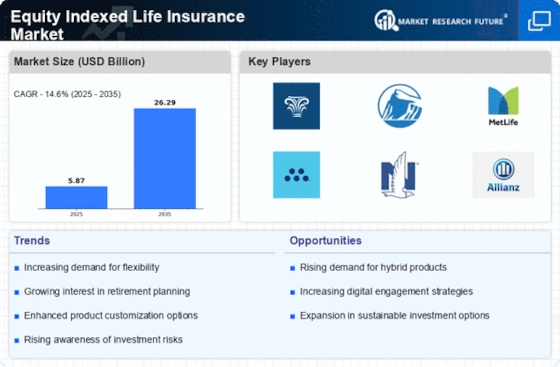

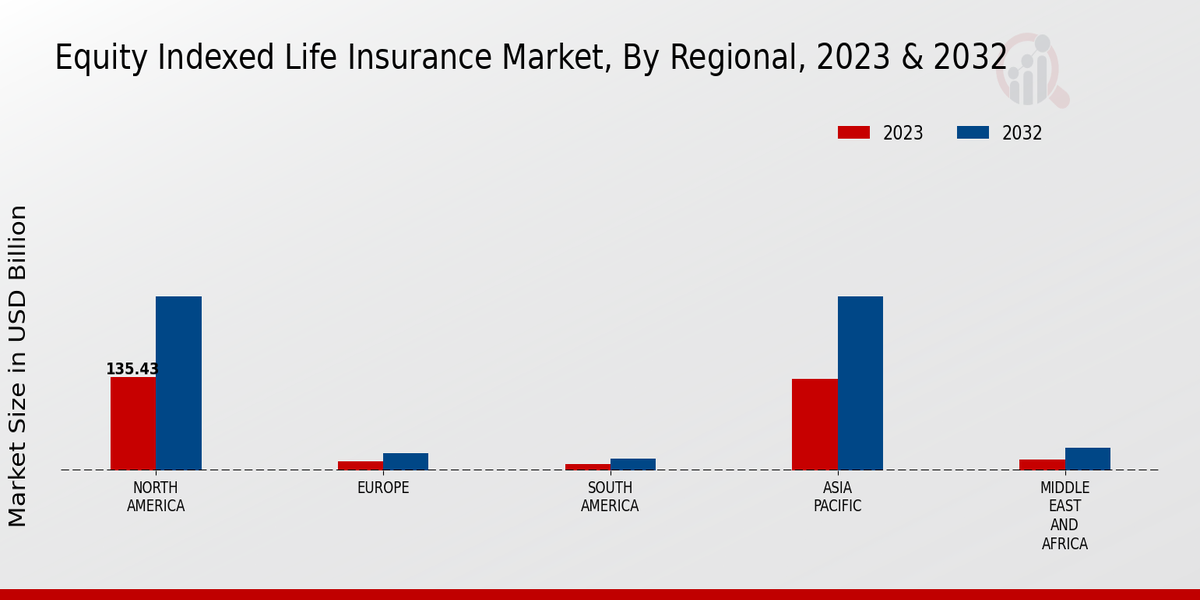

Market Growth Projections

The Global Equity Indexed Life Insurance Market Industry is poised for substantial growth, with projections indicating a market size of 235.94 USD Billion in 2024 and an anticipated increase to 541.32 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 7.84% from 2025 to 2035, reflecting the increasing adoption of equity indexed life insurance products across various demographics. The market dynamics are influenced by factors such as consumer demand for flexible insurance solutions, regulatory support, and technological advancements, all contributing to a robust outlook for the industry.

Regulatory Support and Tax Benefits

The Global Equity Indexed Life Insurance Market Industry benefits from favorable regulatory frameworks and tax incentives that encourage the adoption of life insurance products. Governments in various regions are implementing policies that promote long-term savings and investment through life insurance, often providing tax advantages for policyholders. These incentives not only enhance the appeal of equity indexed life insurance but also contribute to its growth. As consumers leverage these benefits, the market is likely to witness a compound annual growth rate of 7.84% from 2025 to 2035, underscoring the role of regulatory support in driving market expansion.

Increased Focus on Retirement Planning

The Global Equity Indexed Life Insurance Market Industry is witnessing an increased focus on retirement planning as individuals seek to secure their financial future. With traditional pension schemes becoming less reliable, consumers are turning to equity indexed life insurance as a viable alternative for retirement savings. These products not only provide life coverage but also offer growth potential linked to market indices, making them attractive for long-term financial planning. This trend is likely to contribute to the market's expansion, as more individuals recognize the importance of integrating life insurance into their retirement strategies.

Rising Awareness of Financial Planning

In the Global Equity Indexed Life Insurance Market Industry, there is a marked rise in awareness regarding the importance of financial planning. Individuals are becoming more educated about the benefits of life insurance as a tool for wealth management and legacy planning. This heightened awareness is fostering a greater interest in equity indexed life insurance products, which offer both protection and growth potential. As consumers recognize the value of integrating life insurance into their overall financial strategy, the market is expected to expand significantly, with projections indicating a growth trajectory that could see it reach 541.32 USD Billion by 2035.

Growing Demand for Flexible Insurance Products

The Global Equity Indexed Life Insurance Market Industry experiences a notable increase in demand for flexible insurance products that combine life coverage with investment opportunities. Consumers are increasingly seeking policies that not only provide death benefits but also offer potential cash value growth linked to equity market performance. This trend is driven by a desire for financial security and wealth accumulation, particularly among younger demographics. As a result, the market is projected to reach approximately 235.94 USD Billion in 2024, reflecting a shift towards products that align with consumer preferences for adaptability and long-term financial planning.

Technological Advancements in Insurance Solutions

Technological innovations are reshaping the Global Equity Indexed Life Insurance Market Industry by enhancing product offerings and improving customer experience. Insurers are increasingly utilizing advanced analytics, artificial intelligence, and digital platforms to streamline policy management and enhance customer engagement. These advancements facilitate personalized insurance solutions that cater to individual needs, thereby attracting a broader customer base. As technology continues to evolve, it is anticipated that the market will experience substantial growth, driven by the demand for more efficient and user-friendly insurance products that align with modern consumer expectations.

Leave a Comment