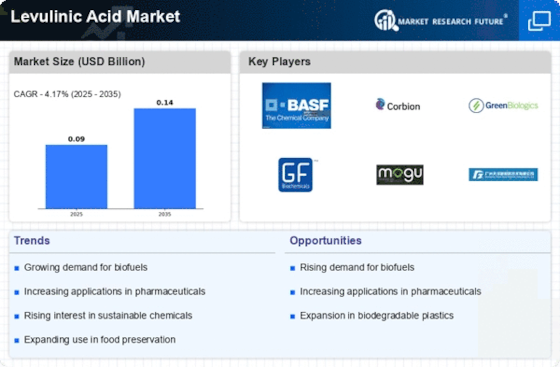

Leading market players are investing heavily in research and development to expand their product lines, which will help the levulinic acid market grow even more. Market participants are also undertaking various strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the levulinic acid industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers use in the levulinic acid industry to benefit clients and increase the market sector. Major players in the Levulinic Acid Market, including G.F. Biochemicals Ltd. (Italy), Biofine International Inc. (U.S.), Avantium (Netherlands), Langfang Triple Well Chemicals Co. Ltd (China), Simagchem Corporation (China), Hefei TNJ Chemical Industry Co., Ltd. (China), and others, are attempting to increase market demand by investing in research and development operations.

Brenntag SE sells and distributes industrial and specialty chemicals. The company also develops and prepares specific chemical compounds and offers analysis services. Brenntag's customers include oil and gas, paint, cosmetic, pharmaceutical, and water treatment companies.

In October Brenntag formed a distribution contract with NXTLEVVEL Biochem to develop its emerging Industrial, Household, and Institution (HI&I) portfolio in providing sustainable biobased solvents in the region. The current contract includes the latest product line, such as the below product names, and comprises levulinates and levulinate ketals. The products are bio-based solvents bringing sustainability, expanded safety, and high performance.

Ford Motor Company and Origin Materials began their Net Zero Automotive Program in 2021. A sustainable automotive supply chain project, the Net Zero Automotive Program aims to industrialize novel materials to promote decarbonization in the automobile sector. With the help of technology developed by Origin Materials, sustainable wood scraps can now be produced into affordable, carbon-negative materials that cut down on the consumption of fossil fuels. The versatile furan CMF (chloromethyl furfural) and the equally versatile resin HTC (hydrothermal carbon) make up the majority of the product.

Levulinic acid and furfural are also produced by the process; none of these produce carbon. Ford and Origin Materials will explore drop-in applications for carbon-negative PET plastic (polyethylene terephthalate) made from sustainable wood waste using Origin technology in order to introduce the Net Zero program. PET plastic helps make cars lighter, more fuel-efficient, and often comprise a large percentage of a vehicle’s mass. The use of carbon-negative PET is expected to further reduce emissions and the need for fossil resources.

GF Biochemicals is a biochemical company founded in 2008. It was co-founded by and named after Pasquale Granata and Mathieu Flamini. It is the first firm in the world able to mass-produce levulinic acid. The company worked with the University of Pisa for seven years on its production. In 2016 GF Biochemicals acquired the American company Segetis.

In June GFBiochemicals agreed with German chemical giant BASF’s European distribution organization, BTC Europe GmbH, on distributing biobased and biodegradable solvents derived from levulinic acid for the European market.