Legumes Size

Legumes Market Growth Projections and Opportunities

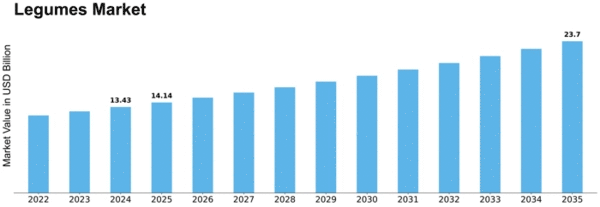

The Legumes Market is influenced by a variety of factors that contribute to its dynamics and growth patterns. One of the primary drivers of this market is the increasing awareness and adoption of plant-based diets. Legumes, which include various types of beans, lentils, and peas, are rich sources of protein, fiber, and essential nutrients, making them a favored choice among individuals seeking plant-based protein alternatives. As the demand for vegetarian and vegan lifestyles continues to rise globally, the legumes market experiences a corresponding surge, driven by the nutritional benefits and versatility of legume-based products. The Global Legumes Market is poised for substantial growth, anticipating a Compound Annual Growth Rate (CAGR) of 5.30% spanning from 2019 to 2024. This robust growth trajectory positions the market to achieve a noteworthy milestone, projecting a market value of USD 18.30 Billion by the year 2032. Several factors contribute to the positive outlook of the legumes market, underlining its potential for significant expansion in the coming years.

The projected CAGR of 5.30% reflects a sustained and steady pace of growth, driven by increasing consumer awareness of the nutritional benefits associated with legumes. As a rich source of protein, fiber, and various essential nutrients, legumes have gained prominence in dietary preferences worldwide, contributing to the market's upward momentum. Additionally, the rising trend of plant-based diets and the growing recognition of legumes as sustainable and environmentally friendly food sources further bolster the market's prospects.

The forecasted market value of USD 18.30 Billion by 2032 signals substantial market maturity and underscores the global demand for legumes. As the market continues to evolve, stakeholders can explore diverse avenues for innovation and investment in this dynamic sector, capitalizing on the sustained growth potential of the global legumes market. Moreover, the growing emphasis on health and wellness is propelling the legumes market forward. Legumes are known to have numerous health benefits, including promoting heart health, aiding in weight management, and contributing to improved digestion. As consumers become increasingly health-conscious and mindful of their dietary choices, the incorporation of legumes into regular meals gains popularity. This trend is not only evident in households but is also reflected in the food industry, where manufacturers are incorporating legume-based ingredients into a variety of products, ranging from snacks to meat alternatives.

The environmental sustainability aspect is another significant factor influencing the legumes market. Legumes are nitrogen-fixing crops that enhance soil fertility, reducing the need for synthetic fertilizers. Their cultivation contributes to sustainable agricultural practices by promoting crop rotation and soil health. As sustainability becomes a focal point for consumers and businesses alike, the demand for legumes as a sustainable and eco-friendly food source is on the rise. This aligns with the broader movement toward more environmentally conscious and responsible food production practices.

The regional production and consumption patterns also play a crucial role in shaping the legumes market. Different types of legumes are staples in various cuisines around the world, and their popularity can vary by region. For example, chickpeas and lentils are widely consumed in Middle Eastern and Indian cuisines, while black beans and pinto beans are staples in Latin American dishes. Understanding and catering to these regional preferences are essential for market players looking to establish a strong presence and meet the diverse demands of consumers globally.

Despite the positive trends, challenges such as allergenicity and anti-nutritional factors present hurdles for the legumes market. Some individuals may be allergic to certain legumes, limiting their consumption options. Additionally, anti-nutritional factors present in some legumes can interfere with nutrient absorption or cause digestive discomfort. Addressing these challenges through research, product innovation, and clear labeling is crucial to expanding the consumer base and ensuring the market's sustained growth.

Leave a Comment