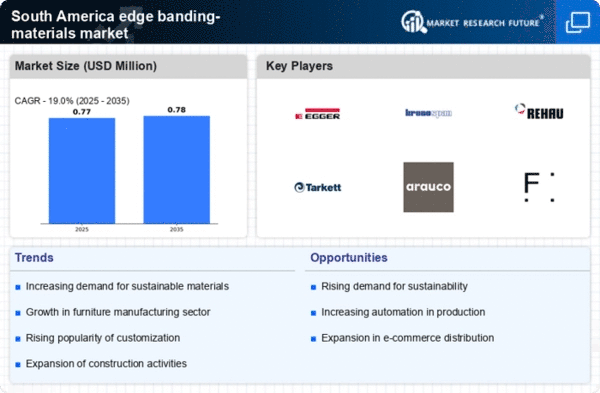

Rising Demand for Furniture

The edge banding-materials market experiences a notable surge in demand driven by the growing furniture industry. As urbanization continues to rise, the need for residential and commercial furniture increases, leading to a higher consumption of edge banding materials. In 2025, the furniture market in South America is projected to reach approximately $30 billion, with a significant portion allocated to edge banding materials. This growth is further fueled by consumer preferences for aesthetically pleasing and durable furniture, which necessitates the use of high-quality edge banding solutions. Manufacturers are thus compelled to innovate and expand their product offerings to meet this rising demand, indicating a robust growth trajectory for the edge banding-materials market in the region.

Expansion of Construction Activities

The edge banding-materials market is significantly influenced by the expansion of construction activities across the region. With increasing investments in infrastructure and residential projects, the demand for high-quality wood products, including furniture and cabinetry, is on the rise. In 2025, the construction sector is expected to grow by approximately 4.5%, which directly correlates with the increased use of edge banding materials. As builders and contractors seek to enhance the aesthetic appeal and durability of their projects, the need for effective edge banding solutions becomes paramount. This trend suggests a promising outlook for the edge banding-materials market, as it aligns with the broader growth of the construction industry.

Consumer Preference for Aesthetic Appeal

In South America, the edge banding-materials market is increasingly shaped by consumer preferences for aesthetic appeal in furniture and cabinetry. As consumers become more design-conscious, the demand for visually appealing edge banding solutions rises. This trend is particularly evident in urban areas where modern design trends dominate. In 2025, it is projected that the market for decorative edge banding materials will grow by approximately 20%, reflecting the shift towards customization and personalization in furniture design. Manufacturers are thus encouraged to diversify their product lines to cater to these evolving consumer tastes, indicating a dynamic landscape for the edge banding-materials market.

Sustainability Trends in Material Sourcing

Sustainability trends are increasingly influencing the edge banding-materials market. As consumers and businesses alike prioritize environmentally friendly practices, the demand for sustainable materials is on the rise. In 2025, it is anticipated that the market for eco-friendly edge banding materials will grow by 25%, driven by a shift towards responsible sourcing and production methods. Manufacturers are responding by developing products that utilize recycled or sustainably sourced materials, aligning with the broader sustainability goals of the region. This trend not only enhances the appeal of edge banding materials but also positions manufacturers favorably in a competitive market, suggesting a positive outlook for the industry.

Technological Innovations in Manufacturing

Technological advancements in manufacturing processes are reshaping the edge banding-materials market. Innovations such as automated edge banding machines and advanced adhesive technologies are enhancing production efficiency and product quality. In 2025, it is estimated that the adoption of these technologies could lead to a 15% reduction in production costs for manufacturers. This not only allows for competitive pricing but also improves the overall quality of edge banding materials, making them more appealing to consumers. As manufacturers invest in these technologies, the edge banding-materials market is likely to witness increased growth, driven by improved product offerings and operational efficiencies.