Rising Demand in Telecommunications

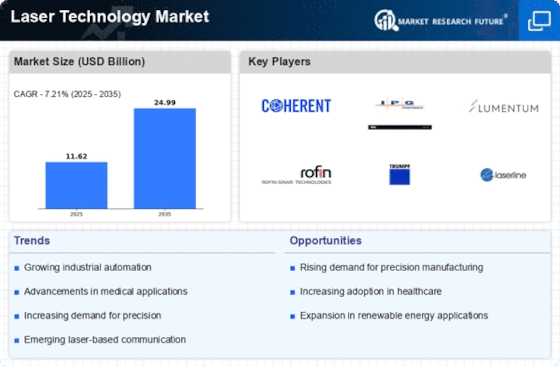

The Laser Technology Market is experiencing a notable surge in demand due to the increasing reliance on fiber optic communication systems. Lasers play a crucial role in transmitting data over long distances with minimal loss. As the need for high-speed internet and efficient communication networks escalates, the adoption of laser technologies in telecommunications is expected to grow significantly. According to recent data, the fiber optic segment is projected to witness a compound annual growth rate of over 10% in the coming years. This trend indicates that investments in laser technology for telecommunications will likely continue to rise, further propelling the Laser Technology Market.

Innovations in Manufacturing Processes

The Laser Technology Market is being driven by innovations in manufacturing processes, particularly in sectors such as automotive and aerospace. Lasers are increasingly utilized for cutting, welding, and engraving materials with precision and efficiency. The adoption of laser-based manufacturing techniques has been shown to enhance productivity and reduce waste, aligning with the industry's push for sustainability. Recent statistics suggest that the use of laser technology in manufacturing could lead to a reduction in production costs by up to 30%. This potential for cost savings and efficiency improvements is likely to attract more manufacturers to invest in laser technologies, thereby boosting the Laser Technology Market.

Advancements in Laser Medical Treatments

The Laser Technology Market is significantly influenced by advancements in medical treatments, particularly in fields such as dermatology, ophthalmology, and surgery. Lasers are utilized for a variety of medical procedures, including laser eye surgery and skin resurfacing, due to their precision and minimal invasiveness. The increasing prevalence of chronic diseases and the aging population are contributing to the rising demand for laser-based medical treatments. Recent data indicates that the medical laser market is projected to grow at a compound annual growth rate of approximately 8% over the next few years. This growth trajectory suggests that the Laser Technology Market will continue to benefit from innovations in medical applications.

Expansion of Defense and Security Applications

The Laser Technology Market is witnessing growth driven by the expansion of defense and security applications. Lasers are employed in various military applications, including target designation, range finding, and directed energy weapons. The increasing focus on national security and defense modernization programs has led to heightened investments in laser technologies. Recent reports indicate that defense spending is expected to rise, with a significant portion allocated to advanced laser systems. This trend suggests that the demand for laser technologies in defense applications will likely continue to grow, further enhancing the Laser Technology Market.

Integration of Laser Technologies in Consumer Electronics

The Laser Technology Market is being propelled by the integration of laser technologies in consumer electronics. Lasers are increasingly used in devices such as printers, scanners, and projectors, enhancing performance and user experience. The demand for high-quality imaging and printing solutions is driving manufacturers to adopt laser technologies, which offer superior resolution and speed. Recent market analysis indicates that the consumer electronics segment is expected to grow at a rate of around 6% annually, reflecting the increasing reliance on laser technologies. This trend suggests that the Laser Technology Market will continue to expand as consumer electronics manufacturers increasingly incorporate laser solutions into their products.