Rising Demand for Research and Development

The Laboratory Chemicals Market is experiencing a notable increase in demand driven by the growing emphasis on research and development across various sectors. Industries such as pharmaceuticals, biotechnology, and environmental science are investing heavily in R&D to innovate and improve their product offerings. This trend is reflected in the substantial growth of the laboratory chemicals segment, which is projected to reach a market value of approximately USD 50 billion by 2026. The need for high-quality chemicals to support complex experiments and analyses is paramount, thereby propelling the Laboratory Chemicals Market forward. Furthermore, the increasing number of research institutions and laboratories worldwide contributes to this rising demand, as they require a consistent supply of specialized chemicals for their operations.

Increased Focus on Quality Control and Assurance

Quality control and assurance have become paramount in the Laboratory Chemicals Market, particularly in sectors such as pharmaceuticals and food safety. Regulatory bodies are imposing stricter guidelines to ensure the safety and efficacy of products, which in turn drives the demand for high-quality laboratory chemicals. Companies are investing in advanced testing and analytical methods to comply with these regulations, leading to an increased consumption of specialized chemicals. The market for laboratory chemicals used in quality control is projected to grow significantly, as organizations prioritize compliance and consumer safety. This trend underscores the importance of reliable laboratory chemicals in maintaining standards and ensuring product integrity within the Laboratory Chemicals Market.

Technological Innovations in Chemical Manufacturing

Technological innovations are reshaping the Laboratory Chemicals Market, enhancing production efficiency and product quality. Advances in chemical manufacturing processes, such as automation and digitalization, are enabling companies to produce chemicals more efficiently and at a lower cost. These innovations not only improve the consistency and reliability of laboratory chemicals but also reduce waste and environmental impact. As a result, manufacturers are better positioned to meet the growing demand for high-quality chemicals. The integration of smart technologies in laboratories is also facilitating real-time monitoring and analysis, further driving the need for advanced laboratory chemicals. This technological evolution is likely to propel the Laboratory Chemicals Market into a new era of efficiency and sustainability.

Expansion of Pharmaceutical and Biotechnology Sectors

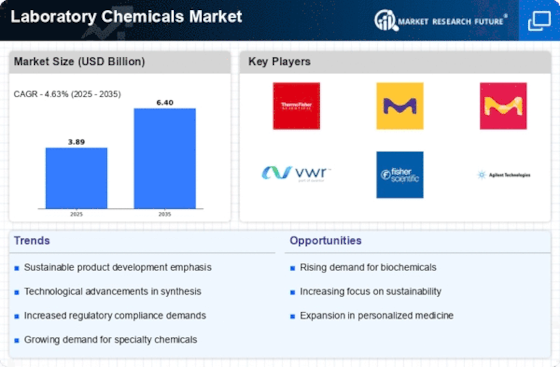

The Laboratory Chemicals Market is significantly influenced by the expansion of the pharmaceutical and biotechnology sectors. As these industries continue to grow, the need for laboratory chemicals to support drug development, testing, and production processes becomes increasingly critical. The pharmaceutical sector alone is expected to witness a compound annual growth rate of around 5% over the next few years, which directly correlates with the demand for laboratory chemicals. This growth is driven by the need for innovative therapies and personalized medicine, necessitating a diverse range of chemicals for research and production. Consequently, the Laboratory Chemicals Market is poised to benefit from this expansion, as companies seek reliable suppliers to meet their evolving needs.

Growing Environmental Concerns and Sustainability Practices

The Laboratory Chemicals Market is increasingly influenced by growing environmental concerns and the adoption of sustainability practices. As awareness of environmental issues rises, laboratories are seeking eco-friendly alternatives to traditional chemicals. This shift is prompting manufacturers to develop sustainable laboratory chemicals that minimize environmental impact while maintaining performance. The market for green chemistry is expanding, with a projected growth rate of over 10% in the coming years. Laboratories are also implementing waste reduction strategies and recycling programs, further driving the demand for sustainable chemicals. This trend not only aligns with The Laboratory Chemicals Industry as a key player in promoting environmentally responsible practices.