Advancements in Analytical Techniques

The laboratory chemicals market in France is significantly impacted by advancements in analytical techniques, which enhance the precision and efficiency of chemical analysis. Innovations such as high-performance liquid chromatography (HPLC) and mass spectrometry are becoming increasingly prevalent in laboratories, necessitating specialized chemicals that can support these advanced methodologies. In 2025, the demand for chemicals tailored for analytical applications is expected to rise by 12%, indicating a shift towards more sophisticated laboratory practices. This evolution suggests that the laboratory chemicals market will continue to evolve, driven by the need for high-quality reagents and solvents that meet the requirements of modern analytical techniques.

Increased Focus on Environmental Testing

The laboratory chemicals market in France is witnessing a heightened focus on environmental testing, driven by growing public awareness and regulatory requirements regarding environmental protection. Laboratories are increasingly tasked with analyzing pollutants and contaminants, necessitating a diverse range of chemicals for accurate testing. In 2025, the market for environmental testing chemicals is projected to grow by 8%, reflecting the urgent need for effective solutions to address environmental challenges. This trend indicates that the laboratory chemicals market will likely adapt to meet the evolving demands of environmental science, thereby expanding its product range and applications.

Rising Demand for Research and Development

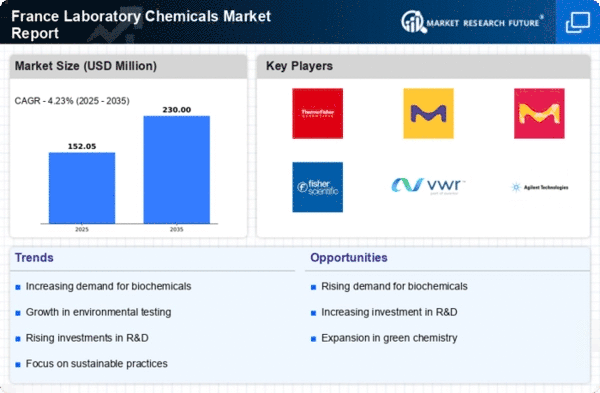

The laboratory chemicals market in France experiences a notable surge in demand driven by the increasing focus on research and development across various sectors, including pharmaceuticals, biotechnology, and environmental science. As organizations invest heavily in innovation, the need for high-quality laboratory chemicals becomes paramount. In 2025, the market is projected to grow at a CAGR of approximately 5.2%, reflecting the critical role that these chemicals play in advancing scientific knowledge and technological breakthroughs. This trend indicates that the laboratory chemicals market is likely to expand as more institutions prioritize R&D initiatives, creating a robust demand for specialized chemicals..

Regulatory Compliance and Quality Standards

The laboratory chemicals market in France is significantly influenced by stringent regulatory compliance and quality standards imposed by governmental bodies. These regulations ensure that chemicals used in laboratories meet safety and efficacy criteria, which is essential for maintaining public health and environmental safety. In 2025, it is estimated that compliance-related expenditures could account for up to 15% of total operational costs for laboratories. This emphasis on quality not only drives demand for certified chemicals but also encourages manufacturers to innovate and improve their product offerings, thereby enhancing the overall landscape of the laboratory chemicals market.

Growth in Educational Institutions and Training Programs

The expansion of educational institutions and training programs in France contributes positively to the laboratory chemicals market. As universities and technical colleges enhance their science curricula, the need for laboratory chemicals increases correspondingly. In 2025, the number of students enrolled in science-related fields is expected to rise by approximately 10%, leading to greater consumption of laboratory chemicals for educational purposes. This growth suggests that the laboratory chemicals market will benefit from a steady influx of new users, thereby fostering a culture of experimentation and research among the younger generation.