Advancements in Drug Formulations

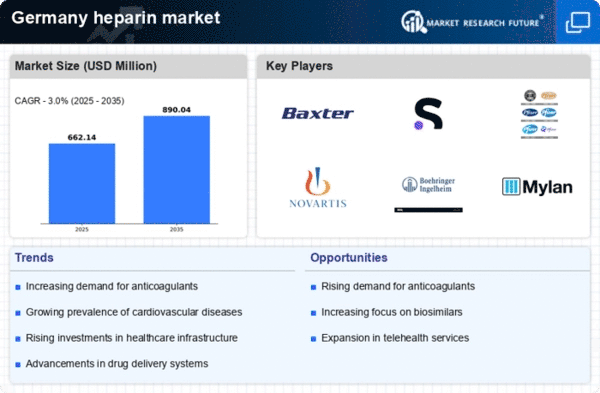

Innovations in drug formulations are shaping the heparin market in Germany. The development of low molecular weight heparins (LMWH) has revolutionized anticoagulation therapy, offering improved efficacy and safety profiles compared to traditional heparin. These advancements are likely to attract more healthcare providers to adopt heparin-based therapies, as they provide better patient outcomes and convenience. Additionally, the introduction of new delivery methods, such as pre-filled syringes, enhances the ease of administration, further driving market growth. As the pharmaceutical industry continues to invest in research and development, the heparin market is expected to experience a compound annual growth rate (CAGR) of around 5% over the next few years, reflecting the positive impact of these innovations.

Expansion of Healthcare Infrastructure

Germany's ongoing investment in healthcare infrastructure significantly impacts the heparin market. The government has been enhancing healthcare facilities, including hospitals and outpatient clinics, to improve patient access to essential medical services. This expansion is likely to increase the availability of heparin treatments, as more healthcare providers adopt anticoagulant therapies in their treatment protocols. Furthermore, the establishment of specialized cardiovascular care centers is expected to drive the demand for heparin, as these facilities often require a steady supply of anticoagulants for various procedures. The market is anticipated to grow as healthcare infrastructure continues to evolve, with projections indicating a potential increase in heparin consumption by 8% over the next few years.

Rising Awareness of Preventive Healthcare

The growing awareness of preventive healthcare measures among the German population is a notable driver for the heparin market. As individuals become more informed about the risks associated with thromboembolic disorders, there is a corresponding increase in the demand for preventive anticoagulant therapies. Educational campaigns and health initiatives aimed at promoting cardiovascular health are likely to contribute to this trend. Consequently, healthcare providers are more inclined to prescribe heparin as a preventive measure, particularly for high-risk patients. This shift in patient behavior is expected to enhance the market landscape, with estimates suggesting a potential growth of 7% in heparin sales as preventive healthcare becomes a priority in treatment strategies.

Regulatory Support for Anticoagulant Therapies

The regulatory environment in Germany is increasingly supportive of anticoagulant therapies, which serves as a significant driver for the heparin market. Regulatory bodies are actively working to streamline the approval processes for new heparin formulations and related products, thereby facilitating quicker access to the market. This supportive framework encourages pharmaceutical companies to invest in the development of novel heparin products, enhancing competition and variety within the market. Furthermore, the emphasis on patient safety and efficacy in regulatory guidelines is likely to foster trust among healthcare providers and patients alike. As a result, the heparin market is projected to grow steadily, with an anticipated increase in product offerings and market penetration.

Increasing Prevalence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases in Germany is a crucial driver for the heparin market. As per recent health statistics, cardiovascular diseases account for a significant portion of mortality rates, prompting a surge in demand for effective anticoagulant therapies. Heparin, being a widely used anticoagulant, plays a vital role in the management of these conditions. The healthcare system's focus on improving patient outcomes through timely interventions further fuels the need for heparin. In 2025, the market is projected to witness a growth rate of approximately 6% annually, driven by the increasing number of patients requiring anticoagulation therapy. This trend indicates a robust market potential for heparin products, as healthcare providers prioritize effective treatment options for cardiovascular patients.