Innovations in Product Formulations

The L-Citrulline Market is witnessing innovations in product formulations that cater to diverse consumer preferences. Manufacturers are increasingly developing L-Citrulline Market products in various forms, including powders, capsules, and ready-to-drink beverages. This diversification allows consumers to choose products that align with their lifestyles and consumption habits. Additionally, the incorporation of L-Citrulline Market into functional foods and beverages is becoming more prevalent, appealing to health-conscious consumers seeking convenient options. As product innovation continues to shape the market, it is anticipated that the availability of L-Citrulline Market in various formats will enhance its appeal and drive further growth in the industry.

Growing Awareness of Health Benefits

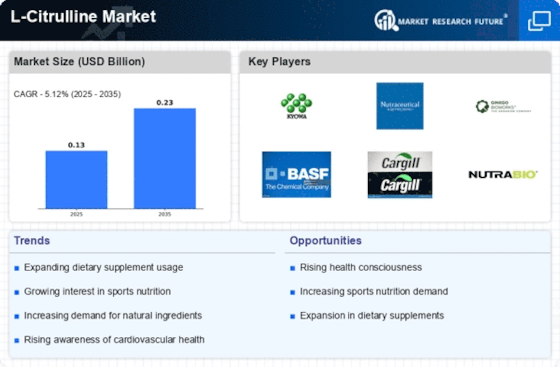

The L-Citrulline Market is experiencing a surge in consumer awareness regarding the health benefits associated with L-Citrulline Market supplementation. Research indicates that L-Citrulline Market may enhance nitric oxide production, which can lead to improved blood flow and cardiovascular health. As consumers become more health-conscious, they are increasingly seeking natural supplements that support overall wellness. This trend is reflected in the rising sales of L-Citrulline Market products, with the market projected to grow at a compound annual growth rate of approximately 8% over the next five years. The increasing prevalence of lifestyle-related health issues further propels the demand for effective dietary supplements, positioning L-Citrulline Market as a favorable option in the health and wellness sector.

Rising Popularity in Sports Nutrition

The L-Citrulline Market is significantly influenced by the growing popularity of sports nutrition products. Athletes and fitness enthusiasts are increasingly turning to L-Citrulline Market for its potential to enhance exercise performance and recovery. Studies suggest that L-Citrulline Market supplementation may reduce muscle soreness and improve endurance, making it a sought-after ingredient in pre-workout formulations. The sports nutrition segment is expected to account for a substantial share of the L-Citrulline Market, driven by the increasing participation in sports and fitness activities. As more individuals engage in regular physical activity, the demand for effective performance-enhancing supplements, including L-Citrulline Market, is likely to rise, further propelling market growth.

Increasing Adoption in Functional Foods

The L-Citrulline Market is experiencing an uptick in the adoption of L-Citrulline Market in functional foods. As consumers become more health-oriented, there is a growing interest in foods that offer additional health benefits beyond basic nutrition. L-Citrulline Market is being integrated into a variety of food products, including energy bars, smoothies, and fortified beverages, to enhance their nutritional profiles. This trend aligns with the broader movement towards functional foods that support health and wellness. The increasing incorporation of L-Citrulline Market into everyday food products is likely to expand its market reach, making it more accessible to a wider audience and contributing to the overall growth of the L-Citrulline Market.

Expansion of Dietary Supplement Industry

The L-Citrulline Market is benefiting from the overall expansion of the dietary supplement industry. With a growing number of consumers incorporating supplements into their daily routines, the demand for L-Citrulline Market is on the rise. The dietary supplement market has been valued at over 140 billion, with projections indicating continued growth as more individuals seek to improve their health and wellness through supplementation. This trend is particularly evident among older adults who are increasingly focused on maintaining vitality and physical performance. As the dietary supplement industry evolves, L-Citrulline Market is likely to gain traction as a key ingredient in various formulations, catering to a diverse consumer base.