Increased Healthcare Expenditure

Japan's healthcare expenditure has been on the rise, which positively impacts the positron emission-tomography-devices market. The government has been increasing its budget allocation for healthcare services, aiming to improve medical infrastructure and access to advanced diagnostic tools. In 2025, healthcare spending is expected to reach approximately $500 billion, with a significant portion directed towards imaging technologies. This financial commitment indicates a robust market environment for PET devices, as hospitals and clinics seek to upgrade their equipment to provide high-quality care. The increased funding is likely to facilitate the adoption of innovative PET technologies, thereby enhancing the overall growth of the positron emission-tomography-devices market.

Rising Demand for Early Diagnosis

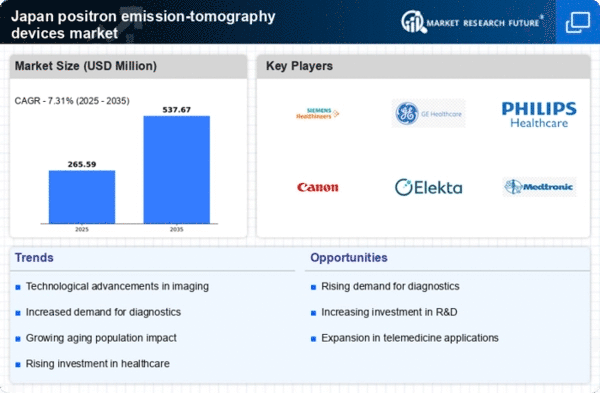

The increasing emphasis on early diagnosis of diseases, particularly cancer, is driving the positron emission-tomography-devices market in Japan. With advancements in imaging technology, healthcare providers are increasingly adopting PET devices to enhance diagnostic accuracy. The market is projected to grow at a CAGR of approximately 8% from 2025 to 2030, reflecting the rising demand for non-invasive diagnostic tools. This trend is further supported by the growing awareness among patients regarding the benefits of early detection, which can lead to better treatment outcomes. Consequently, the positron emission-tomography-devices market is likely to witness a surge in demand as healthcare facilities invest in advanced imaging technologies to meet patient needs.

Rising Incidence of Chronic Diseases

The increasing prevalence of chronic diseases, particularly cancer and cardiovascular conditions, is significantly influencing the positron emission-tomography-devices market in Japan. As the population ages, the demand for effective diagnostic tools to manage these diseases is escalating. PET devices are recognized for their ability to provide detailed images that assist in the diagnosis and monitoring of chronic conditions. The market is projected to expand as healthcare providers seek to incorporate PET technology into their diagnostic protocols. This trend indicates a growing recognition of the importance of advanced imaging in the management of chronic diseases, thereby driving the positron emission-tomography-devices market.

Growing Research and Development Activities

The positron emission-tomography-devices market in Japan is experiencing growth due to heightened research and development activities in the medical imaging sector. Japanese institutions and companies are investing significantly in R&D to innovate and improve PET technologies. This focus on R&D is expected to lead to the introduction of advanced PET devices with enhanced capabilities, such as improved resolution and faster imaging times. As a result, the market is likely to benefit from the introduction of cutting-edge technologies that can cater to the evolving needs of healthcare providers. The emphasis on R&D not only fosters innovation but also positions Japan as a leader in the positron emission-tomography-devices market.

Collaboration Between Public and Private Sectors

Collaboration between public and private sectors is emerging as a key driver for the positron emission-tomography-devices market in Japan. Joint initiatives aimed at enhancing healthcare delivery and technological advancements are becoming increasingly common. These partnerships often result in shared resources, knowledge, and funding, which can accelerate the development and deployment of PET technologies. For instance, collaborations between universities and medical device manufacturers have led to breakthroughs in imaging techniques. Such synergies are likely to create a more dynamic market environment, fostering innovation and improving access to advanced diagnostic tools in the positron emission-tomography-devices market.