Integration of IoT Devices

The integration of Internet of Things (IoT) devices into everyday life in Japan is significantly impacting the mobile security market. As more households and businesses adopt IoT technologies, the potential attack surface for cyber threats expands. This trend necessitates comprehensive mobile security solutions that can protect not only smartphones but also interconnected devices. The mobile security market is responding by developing solutions that address the unique security challenges posed by IoT. With an estimated 50 million IoT devices expected to be in use by 2026, the demand for integrated security solutions is likely to grow, prompting innovation and investment in the mobile security sector.

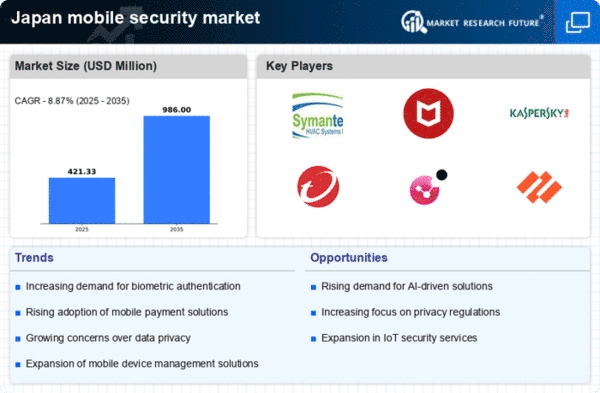

Surge in Mobile Device Usage

The rapid proliferation of mobile devices in Japan has catalyzed a heightened focus on the mobile security market. As of 2025, approximately 80% of the population utilizes smartphones, leading to an increased vulnerability to cyber threats. This surge in mobile device usage necessitates robust security measures to protect sensitive data. The mobile security market is responding to this demand by developing advanced security solutions tailored for mobile platforms. With the rise of mobile banking and e-commerce, the need for secure transactions has become paramount. Consequently, businesses are investing in mobile security solutions to safeguard customer information, thereby driving market growth.

Emergence of Advanced Threats

The mobile security market is currently facing an evolving landscape of sophisticated cyber threats. In Japan, the rise of malware, phishing attacks, and ransomware targeting mobile devices has prompted a reevaluation of security strategies. As cybercriminals become more adept at exploiting vulnerabilities, the demand for advanced mobile security solutions is escalating. The mobile security market is responding by innovating technologies such as artificial intelligence and machine learning to detect and mitigate these threats in real-time. This proactive approach is crucial, as it is estimated that mobile malware attacks could increase by 30% in the coming years, underscoring the urgent need for enhanced security measures.

Consumer Awareness and Education

Consumer awareness regarding mobile security risks is gradually increasing in Japan, influencing the mobile security market. As individuals become more informed about potential threats, there is a growing demand for security solutions that offer transparency and user-friendly interfaces. The mobile security market is adapting by providing educational resources and tools that empower users to protect their devices. This trend is likely to foster a more security-conscious consumer base, which could lead to a projected 20% increase in the adoption of mobile security applications by 2027. Enhanced consumer education is essential for driving the market forward and ensuring that users are equipped to handle security challenges.

Government Regulations and Compliance

In Japan, stringent government regulations regarding data protection and privacy are significantly influencing the mobile security market. The Personal Information Protection Act (PIPA) mandates organizations to implement adequate security measures to protect personal data. As compliance becomes increasingly critical, businesses are compelled to adopt mobile security solutions that align with these regulations. The mobile security market is witnessing a surge in demand for compliance-driven security technologies. This trend is expected to continue, with an estimated growth rate of 15% in compliance-related mobile security solutions by 2026. Organizations that fail to comply may face substantial penalties, further incentivizing investment in mobile security.