Rising Cancer Incidence

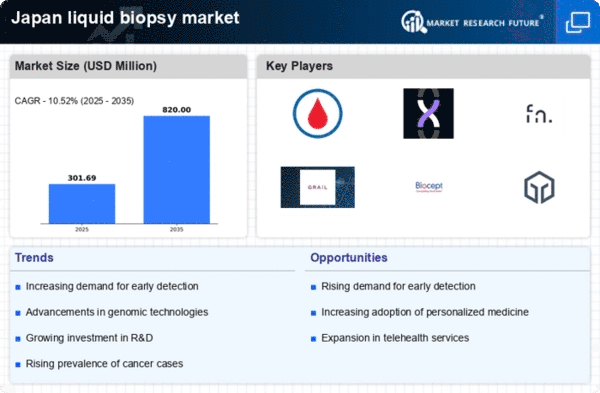

The increasing incidence of cancer in Japan is a primary driver for the liquid biopsy market. According to the latest statistics, cancer remains one of the leading causes of mortality in the country, with approximately 1 in 3 individuals diagnosed during their lifetime. This alarming trend has prompted healthcare providers and researchers to seek innovative diagnostic solutions. Liquid biopsy offers a non-invasive alternative to traditional tissue biopsies, enabling early detection and monitoring of cancer progression. The liquid biopsy market is expected to benefit significantly from this rising demand, as it provides a more patient-friendly approach to cancer diagnostics. Furthermore, the market is projected to grow at a CAGR of around 15% over the next five years, driven by advancements in technology and increased awareness among healthcare professionals.

Regulatory Framework Enhancements

Enhancements in the regulatory framework surrounding liquid biopsy technologies are fostering growth in the market. In Japan, regulatory bodies are increasingly recognizing the importance of liquid biopsies in clinical practice. Streamlined approval processes for innovative diagnostic tests are encouraging companies to invest in the development of liquid biopsy solutions. This supportive regulatory environment is likely to facilitate faster market entry for new products, thereby expanding the liquid biopsy market. As regulations evolve to accommodate advancements in technology, the market could experience a significant uptick in new entrants and innovations, contributing to a more competitive landscape.

Technological Innovations in Diagnostics

Technological advancements in diagnostic tools are reshaping the liquid biopsy market. Innovations such as next-generation sequencing (NGS) and digital PCR are enhancing the sensitivity and specificity of liquid biopsies. These technologies allow for the detection of minimal residual disease and genetic mutations with unprecedented accuracy. In Japan, the integration of artificial intelligence in data analysis is further streamlining the interpretation of complex genomic data. The liquid biopsy market is likely to see substantial growth as these technologies become more accessible to healthcare providers. The market is anticipated to reach a valuation of approximately $1 billion by 2027, reflecting the increasing adoption of advanced diagnostic methods in clinical settings.

Growing Awareness Among Healthcare Professionals

The growing awareness among healthcare professionals regarding the benefits of liquid biopsy is influencing the market positively. Educational initiatives and training programs are being implemented to familiarize clinicians with the advantages of non-invasive testing methods. As healthcare providers become more knowledgeable about the capabilities of liquid biopsies, the adoption rate is likely to increase. This trend is particularly evident in oncology, where liquid biopsies are being recognized for their role in personalized medicine. The liquid biopsy market is expected to expand as more healthcare professionals advocate for these innovative diagnostic tools, potentially leading to a market growth rate of around 12% annually.

Increased Investment in Research and Development

Investment in research and development (R&D) is a crucial driver for the liquid biopsy market. In Japan, both public and private sectors are allocating significant funds to explore the potential of liquid biopsies in various applications, including oncology and prenatal testing. The Japanese government has recognized the importance of innovative healthcare solutions and is providing grants and incentives to support R&D initiatives. This focus on innovation is expected to accelerate the development of new liquid biopsy technologies and expand their clinical applications. The liquid biopsy market could witness a surge in new product launches and partnerships, enhancing competition and driving down costs for consumers.