Rising Incidence of Cancer

The increasing incidence of cancer in the US is a primary driver for the liquid biopsy market. According to the American Cancer Society, approximately 1.9 million new cancer cases are expected to be diagnosed in 2025. This alarming statistic underscores the urgent need for innovative diagnostic tools. Liquid biopsies offer a non-invasive alternative to traditional tissue biopsies, enabling earlier detection and monitoring of cancer progression. As healthcare providers seek to improve patient outcomes, the demand for liquid biopsy solutions is likely to rise. The liquid biopsy market is poised to benefit from this trend, as it aligns with the growing emphasis on personalized medicine and targeted therapies.

Expansion of Biomarker Research

The expansion of biomarker research is a crucial factor propelling the liquid biopsy market. As researchers identify new biomarkers associated with various diseases, the potential applications for liquid biopsies continue to grow. This trend is particularly evident in oncology, where liquid biopsies are being developed to detect specific tumor markers. The liquid biopsy market is benefiting from collaborations between academic institutions and biotechnology companies, leading to innovative product development. With an estimated 30% increase in biomarker discovery initiatives in 2025, the market is likely to experience significant growth as these advancements translate into clinical applications.

Technological Innovations in Diagnostics

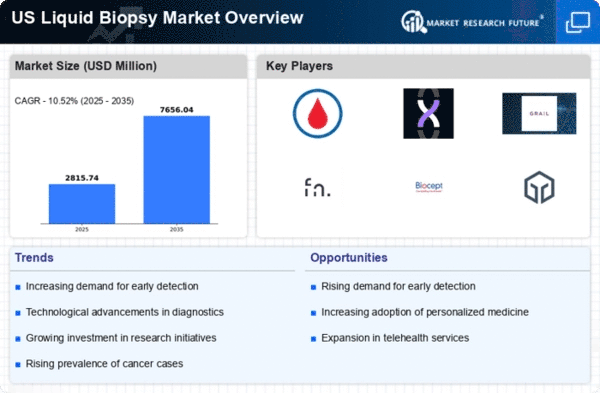

Technological advancements in diagnostic tools are significantly influencing the liquid biopsy market. Innovations such as next-generation sequencing (NGS) and digital PCR are enhancing the sensitivity and specificity of liquid biopsies. These technologies allow for the detection of minimal residual disease and genetic mutations with greater accuracy. The liquid biopsy market is experiencing a surge in research and development activities, with investments reaching approximately $1.5 billion in 2025. This influx of funding is expected to accelerate the introduction of novel liquid biopsy products, thereby expanding the market and improving patient care.

Increased Focus on Early Disease Detection

The heightened focus on early disease detection is significantly impacting the liquid biopsy market. Early diagnosis is critical for improving treatment outcomes, particularly in cancer care. Liquid biopsies facilitate the detection of circulating tumor DNA and other biomarkers at earlier stages of disease progression. The liquid biopsy market is responding to this demand by developing tests that can be integrated into routine screening protocols. As healthcare systems prioritize preventive care, the market is expected to grow, with projections indicating a potential market value of $5 billion by 2027. This emphasis on early detection aligns with broader public health initiatives aimed at reducing mortality rates.

Growing Demand for Minimally Invasive Procedures

The increasing preference for minimally invasive procedures is driving the liquid biopsy market. Patients and healthcare providers alike are recognizing the benefits of non-invasive testing methods, which reduce recovery time and associated risks. Liquid biopsies, which utilize blood samples, align with this trend by offering a safer alternative to traditional biopsies. The liquid biopsy market is likely to see a substantial increase in adoption rates, as studies indicate that over 70% of patients prefer non-invasive testing options. This shift in patient preference is expected to propel market growth in the coming years.