Rising Industrial Automation

The increasing trend of industrial automation in Japan is driving the fiber optic-sensor market. As industries seek to enhance efficiency and reduce operational costs, the demand for advanced sensing technologies is on the rise. Fiber optic sensors offer high precision and reliability, making them ideal for monitoring various parameters in manufacturing processes. The market is projected to grow as companies invest in automation solutions, with an estimated growth rate of 15% annually. This shift towards automation not only improves productivity but also necessitates the integration of sophisticated monitoring systems, further propelling the fiber optic-sensor market.

Advancements in Telecommunications

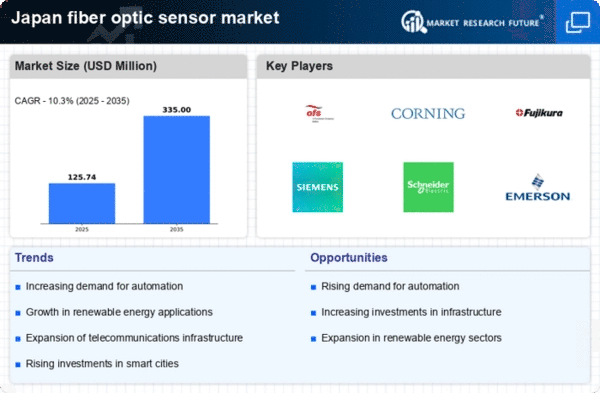

The telecommunications sector in Japan is undergoing rapid advancements, which is positively impacting the fiber optic-sensor market. As the demand for high-speed internet and reliable communication networks increases, fiber optic technology is becoming essential. Fiber optic sensors are utilized for monitoring network performance and ensuring optimal operation. The market is projected to grow by around 10% as telecommunications companies invest in upgrading their infrastructure. This growth is driven by the need for enhanced data transmission capabilities and the reliability that fiber optic sensors provide, making them a critical component in the telecommunications landscape.

Environmental Monitoring Initiatives

Japan's commitment to environmental sustainability is significantly influencing the fiber optic-sensor market. With increasing regulations aimed at reducing pollution and monitoring environmental conditions, the demand for fiber optic sensors is expected to rise. These sensors are capable of providing real-time data on various environmental parameters, such as temperature, pressure, and chemical composition. The market is anticipated to expand as industries and government agencies invest in advanced monitoring solutions to comply with environmental standards. This trend could lead to a market growth of approximately 12% over the next few years, highlighting the importance of fiber optic sensors in environmental applications.

Growing Focus on Safety and Security

The heightened emphasis on safety and security across various sectors in Japan is contributing to the growth of the fiber optic-sensor market. Industries such as oil and gas, transportation, and construction are increasingly adopting fiber optic sensors for monitoring critical infrastructure and ensuring safety. These sensors can detect changes in temperature, pressure, and strain, providing early warnings of potential hazards. The market is expected to expand by approximately 14% as organizations prioritize safety measures and invest in advanced monitoring technologies. This trend underscores the vital role of fiber optic sensors in enhancing safety protocols.

Increased Research and Development Activities

The fiber optic-sensor market is benefiting from increased research and development activities in Japan. Academic institutions and private companies are investing in innovative sensor technologies to enhance performance and expand applications. This focus on R&D is likely to lead to the development of next-generation fiber optic sensors with improved sensitivity and functionality. The market could see a growth rate of around 11% as new technologies emerge, enabling broader applications in fields such as healthcare, aerospace, and structural monitoring. This trend highlights the dynamic nature of the fiber optic-sensor market and its potential for future advancements.