Advancements in Sensor Technology

Technological advancements play a crucial role in shaping the Distributed Fiber Optic Sensor in Oil Gas Market. Innovations in sensor technology, such as improved sensitivity and data processing capabilities, are enhancing the performance and reliability of fiber optic sensors. These advancements enable more accurate monitoring of various parameters, including temperature, pressure, and strain, which are vital for the oil and gas sector. As technology continues to evolve, the integration of artificial intelligence and machine learning with fiber optic sensors is expected to further enhance their capabilities. This trend is likely to attract more investments in the market, as companies seek to leverage cutting-edge technology for improved operational efficiency.

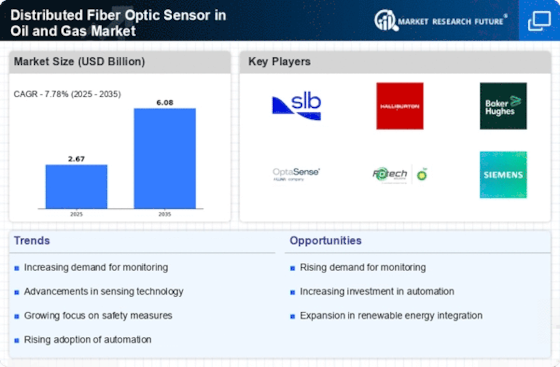

Increased Demand for Real-Time Monitoring

The Distributed Fiber Optic Sensor in Oil Gas Market is experiencing heightened demand for real-time monitoring solutions. This trend is driven by the need for enhanced safety and operational efficiency in oil and gas operations. Real-time data allows for immediate detection of leaks, temperature fluctuations, and other critical parameters, thereby reducing the risk of accidents. According to recent estimates, the market for real-time monitoring solutions is projected to grow at a compound annual growth rate of approximately 15% over the next five years. This growth is indicative of the industry's shift towards more proactive management of resources, which is facilitated by the capabilities of distributed fiber optic sensors.

Regulatory Compliance and Safety Standards

The Distributed Fiber Optic Sensor in Oil Gas Market is significantly influenced by stringent regulatory compliance and safety standards. Governments and regulatory bodies are increasingly mandating the implementation of advanced monitoring technologies to ensure environmental protection and worker safety. The adoption of distributed fiber optic sensors aligns with these regulations, as they provide comprehensive monitoring capabilities that can detect hazardous conditions in real-time. As a result, companies are investing in these technologies to meet compliance requirements, which is expected to drive market growth. The market is anticipated to expand as more operators recognize the importance of adhering to safety regulations while optimizing their operations.

Cost Efficiency and Operational Optimization

Cost efficiency remains a pivotal driver in the Distributed Fiber Optic Sensor in Oil Gas Market. Companies are under constant pressure to reduce operational costs while maximizing output. Distributed fiber optic sensors offer a cost-effective solution by enabling predictive maintenance and reducing downtime. By providing continuous monitoring of critical infrastructure, these sensors help identify potential failures before they occur, thus minimizing repair costs and production losses. Industry reports suggest that the implementation of such technologies can lead to a reduction in operational costs by up to 20%. This financial incentive is likely to encourage further adoption of distributed fiber optic sensors across the sector.

Growing Focus on Environmental Sustainability

The Distributed Fiber Optic Sensor in Oil Gas Market is increasingly influenced by a growing focus on environmental sustainability. As the oil and gas sector faces pressure to reduce its carbon footprint, companies are turning to advanced monitoring solutions to minimize environmental impact. Distributed fiber optic sensors facilitate the detection of leaks and emissions, allowing for timely interventions that can prevent environmental damage. This proactive approach not only helps in compliance with environmental regulations but also enhances the company's reputation. The market is expected to see a rise in demand for these sensors as organizations prioritize sustainability initiatives and seek to adopt technologies that support their environmental goals.