Shift Towards Remote Work

The digital vault market is also influenced by the ongoing shift towards remote work in Japan. As more employees work from home, the demand for secure access to sensitive data has surged. Companies are increasingly adopting digital vault solutions to ensure that their remote workforce can access critical information securely. According to recent statistics, approximately 30% of the Japanese workforce is expected to work remotely by 2025, which necessitates robust data protection measures. This trend suggests that the digital vault market will continue to expand as organizations seek to provide secure environments for remote operations.

Increasing Cybersecurity Threats

The digital vault market in Japan is experiencing growth due to the rising incidence of cybersecurity threats. As organizations face sophisticated attacks, the need for secure data storage solutions becomes paramount. In 2025, it is estimated that cybercrime could cost the global economy over $10 trillion annually, prompting Japanese companies to invest heavily in digital vault solutions. This trend indicates a shift towards prioritizing data protection, as businesses seek to safeguard sensitive information from breaches. The digital vault market is thus positioned to benefit from this heightened awareness and urgency surrounding cybersecurity, as firms look for reliable ways to secure their data assets.

Regulatory Framework Enhancements

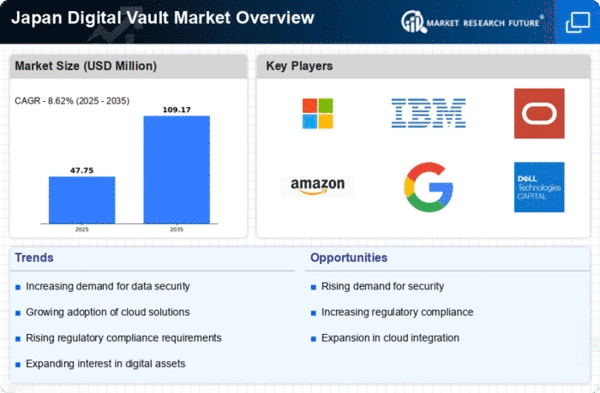

The digital vault market is being shaped by enhancements in regulatory frameworks in Japan. Recent updates to data protection laws have mandated stricter compliance measures for organizations handling sensitive information. As a result, businesses are increasingly turning to digital vault solutions to ensure compliance with these regulations. The digital vault market is likely to benefit from this trend, as companies seek to avoid penalties and maintain their reputations by implementing robust data security measures. This regulatory landscape creates a favorable environment for the growth of digital vault solutions in Japan.

Growing Adoption of Cloud Technologies

The digital vault market in Japan is witnessing a significant uptick due to the growing adoption of cloud technologies. As businesses migrate to cloud-based solutions, the need for secure data storage becomes increasingly critical. In 2025, it is projected that the cloud computing market in Japan will reach approximately $20 billion, driving demand for digital vault solutions that can integrate seamlessly with cloud infrastructures. This trend indicates that the digital vault market is likely to thrive as organizations seek to enhance their data security while leveraging the benefits of cloud computing.

Rising Consumer Awareness of Data Privacy

Consumer awareness regarding data privacy is on the rise in Japan, influencing the digital vault market. As individuals become more informed about their rights and the importance of data protection, businesses are compelled to adopt secure storage solutions. Surveys indicate that over 70% of Japanese consumers are concerned about how their data is handled, prompting companies to prioritize data security. This heightened awareness suggests that the digital vault market will see increased demand as organizations strive to meet consumer expectations and regulatory requirements for data protection.