Rising Cybersecurity Threats

The digital vault market is experiencing heightened demand due to the increasing prevalence of cybersecurity threats in Canada. Organizations are recognizing the necessity of safeguarding sensitive data against breaches and unauthorized access. In 2025, it is estimated that cybercrime could cost Canadian businesses upwards of $10 billion annually. This alarming trend compels companies to invest in robust digital vault solutions that offer advanced encryption and secure access controls. As a result, the digital vault market is likely to expand as businesses prioritize data protection and compliance with stringent regulations. The emphasis on cybersecurity is not merely a trend but a fundamental shift in how organizations approach data management, thereby driving growth in the digital vault market.

Increased Focus on Data Privacy

In Canada, the growing emphasis on data privacy is a critical driver for the digital vault market. With the implementation of stringent data protection regulations, such as the Personal Information Protection and Electronic Documents Act (PIPEDA), organizations are compelled to adopt solutions that ensure compliance. The digital vault market is likely to benefit from this regulatory landscape, as businesses seek to protect personal and sensitive information. In 2025, it is projected that the demand for data privacy solutions will increase by approximately 30%. This heightened focus on privacy not only drives the adoption of digital vaults but also encourages innovation within the industry, as companies strive to meet evolving regulatory requirements.

Emergence of Remote Work Culture

The rise of remote work culture in Canada is significantly impacting the digital vault market. As more organizations adopt flexible work arrangements, the need for secure remote access to sensitive data has become paramount. In 2025, it is projected that approximately 40% of the Canadian workforce will be working remotely, necessitating robust digital vault solutions that facilitate secure data access from various locations. This shift not only highlights the importance of data security but also drives innovation within the digital vault market, as companies seek to provide employees with secure and efficient access to critical information. The emergence of remote work is likely to continue shaping the landscape of the digital vault market.

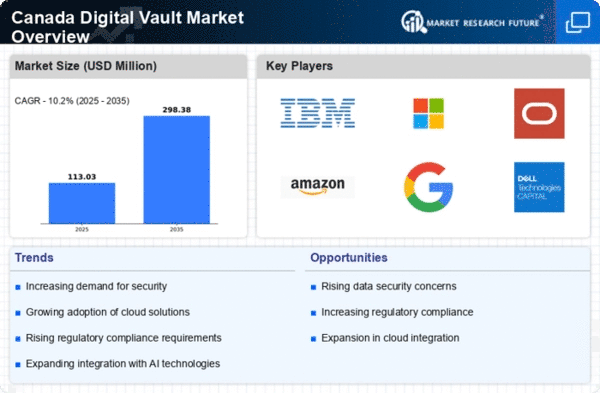

Growing Adoption of Cloud Solutions

The digital vault market is witnessing a surge in demand due to the increasing adoption of cloud-based solutions in Canada. As organizations migrate their operations to the cloud, the need for secure data storage and management becomes critical. In 2025, it is estimated that over 60% of Canadian businesses will utilize cloud services, creating a substantial market for digital vault solutions. Cloud-based digital vaults offer scalability, flexibility, and enhanced security features, making them an attractive option for businesses. This trend indicates a shift in how organizations perceive data management, further propelling the growth of the digital vault market as companies seek to leverage cloud technology while ensuring data security.

Shift Towards Digital Transformation

The ongoing digital transformation across various sectors in Canada is significantly influencing the digital vault market. Organizations are increasingly adopting digital solutions to enhance operational efficiency and customer engagement. According to recent studies, approximately 70% of Canadian companies are in the process of implementing digital transformation strategies. This shift necessitates secure data storage and management solutions, propelling the demand for digital vaults. As businesses transition to digital platforms, the need for reliable and secure data management systems becomes paramount. Consequently, the digital vault market is poised for growth as organizations seek to integrate secure data solutions into their digital transformation initiatives.