Rising Cyber Threat Landscape

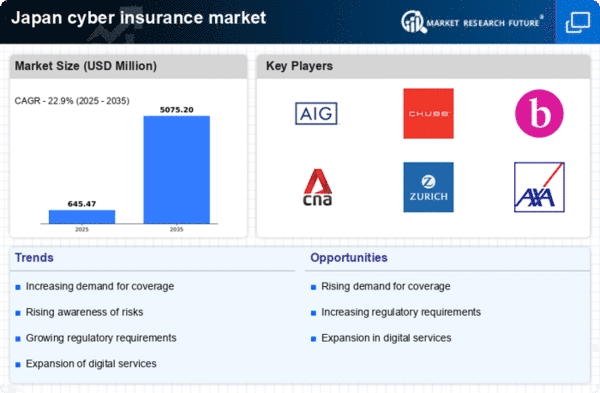

The cyber insurance market in Japan is experiencing growth due to an increasingly complex cyber threat landscape. Cyberattacks, including ransomware and data breaches, have surged, prompting organizations to seek protection. In 2025, it is estimated that cybercrime costs could reach ¥1 trillion, highlighting the urgent need for robust insurance solutions. As businesses recognize the financial implications of cyber incidents, the demand for tailored coverage options is likely to rise. This trend indicates that companies are prioritizing risk management strategies, thereby driving the cyber insurance market forward. The heightened awareness of potential vulnerabilities is fostering a culture of proactive risk assessment, which is essential for the sustainability of the cyber insurance market in Japan.

Growing Awareness of Cyber Risks

There is a notable increase in awareness regarding cyber risks among Japanese businesses. As incidents of cyberattacks become more publicized, organizations are beginning to understand the potential financial repercussions. This heightened awareness is driving demand for cyber insurance, as companies seek to protect their assets and reputation. In 2025, it is estimated that 60% of small and medium-sized enterprises (SMEs) will consider purchasing cyber insurance, reflecting a shift in mindset towards proactive risk management. The growing recognition of cyber threats is likely to bolster the cyber insurance market, as businesses strive to secure their operations against unforeseen cyber incidents.

Increased Regulatory Requirements

The regulatory environment in Japan is evolving, with authorities implementing stricter data protection laws. These regulations compel organizations to adopt comprehensive cybersecurity measures, which often include obtaining cyber insurance. As of November 2025, it is anticipated that compliance costs for businesses could rise by 20%, prompting them to seek financial protection through insurance. This regulatory pressure is likely to drive the cyber insurance market, as companies recognize the necessity of safeguarding against potential liabilities. The interplay between regulatory compliance and insurance coverage is becoming increasingly significant, suggesting that businesses will prioritize obtaining cyber insurance to mitigate risks associated with non-compliance.

Technological Advancements in Risk Assessment

Technological advancements are significantly influencing the cyber insurance market in Japan. The integration of artificial intelligence and machine learning in risk assessment processes allows insurers to evaluate potential threats more accurately. This innovation enhances underwriting practices, enabling insurers to offer more precise policies tailored to individual business needs. As of 2025, it is projected that the adoption of advanced analytics will increase by 30%, further refining risk evaluation methodologies. Consequently, this trend is likely to attract more businesses to the cyber insurance market, as they seek coverage that aligns with their specific risk profiles. The ongoing evolution of technology is thus a critical driver for the growth of the cyber insurance market.

Expansion of Digital Transformation Initiatives

The ongoing digital transformation initiatives across various sectors in Japan are significantly impacting the cyber insurance market. As organizations increasingly adopt cloud services and digital platforms, they expose themselves to new cyber risks. This trend is likely to drive the demand for cyber insurance, as businesses seek to mitigate the risks associated with digital operations. By 2025, it is projected that 70% of enterprises will have migrated to cloud-based solutions, necessitating comprehensive insurance coverage. The expansion of digital initiatives underscores the importance of cyber insurance as a critical component of risk management strategies, thereby propelling the growth of the cyber insurance market.