Rising Cyber Threat Landscape

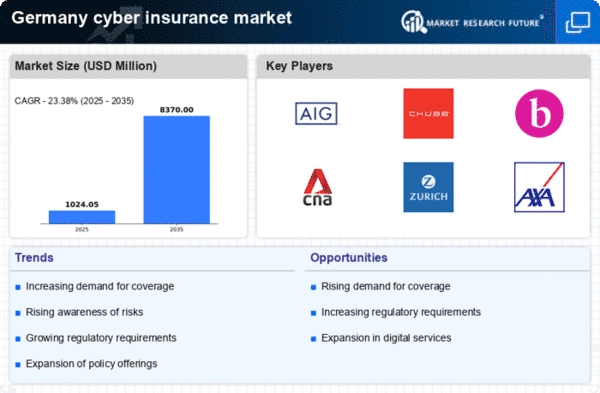

The cyber insurance market in Germany is experiencing growth due to an escalating threat landscape. Cyberattacks, including ransomware and data breaches, have surged, prompting organizations to seek protection. In 2025, it is estimated that cybercrime costs Germany approximately €200 billion annually, highlighting the urgent need for insurance solutions. As businesses recognize the financial implications of cyber incidents, the demand for cyber insurance policies is likely to increase. This trend is further supported by the growing awareness of the potential reputational damage that can arise from data breaches. Consequently, the rising cyber threat landscape is a significant driver for the cyber insurance market, as companies strive to mitigate risks and safeguard their assets.

Increased Regulatory Pressures

The cyber insurance market in Germany is influenced by heightened regulatory pressures aimed at enhancing cybersecurity measures. The implementation of the EU's General Data Protection Regulation (GDPR) has compelled organizations to adopt stringent data protection practices. Non-compliance can result in fines up to €20 million or 4% of annual global turnover, which underscores the importance of cyber insurance. As regulations evolve, businesses are increasingly recognizing the necessity of insurance coverage to comply with legal requirements and protect against potential liabilities. This regulatory environment is likely to drive growth in the cyber insurance market, as companies seek to align their risk management strategies with compliance mandates.

Rising Awareness of Cyber Risks

The cyber insurance market in Germany is benefiting from a rising awareness of cyber risks among businesses and consumers. Educational campaigns and high-profile cyber incidents have heightened public consciousness regarding the potential consequences of cyberattacks. In 2025, surveys indicate that approximately 60% of German companies recognize the importance of cyber insurance as a risk management tool. This growing awareness is likely to drive demand for tailored insurance products that address specific vulnerabilities. As organizations become more proactive in managing cyber risks, the cyber insurance market is expected to expand, reflecting a shift in mindset towards prioritizing cybersecurity.

Growing Digital Transformation Initiatives

The ongoing digital transformation initiatives across various sectors in Germany are propelling the cyber insurance market. As organizations increasingly adopt cloud computing, IoT, and other digital technologies, they expose themselves to new vulnerabilities. In 2025, it is projected that over 70% of German companies will have migrated to cloud services, amplifying the need for robust cybersecurity measures. This shift necessitates comprehensive insurance solutions to address the unique risks associated with digital operations. Consequently, the growing digital transformation initiatives are likely to stimulate demand for cyber insurance, as businesses seek to protect their digital assets and ensure business continuity.

Increased Investment in Cybersecurity Solutions

The cyber insurance market in Germany is being bolstered by increased investment in cybersecurity solutions. Organizations are allocating substantial budgets to enhance their cybersecurity infrastructure, with spending projected to reach €10 billion in 2025. This investment is driven by the recognition that robust cybersecurity measures can reduce the likelihood of incidents and, consequently, the need for insurance claims. As companies implement advanced security technologies, they may also seek cyber insurance to complement their risk management strategies. This synergy between cybersecurity investments and insurance coverage is likely to foster growth in the cyber insurance market, as businesses aim to create a comprehensive defense against cyber threats.