Growing Adoption in Healthcare

The healthcare sector in Japan is increasingly adopting augmented virtual-reality-hardware solutions for various applications, including surgical training, patient rehabilitation, and medical education. This trend is driven by the need for more effective training tools and patient engagement strategies. Recent studies indicate that the use of augmented reality in medical training can enhance learning outcomes by up to 30%. Additionally, healthcare professionals are utilizing virtual reality for pain management and therapy, which has shown promising results in improving patient experiences. Consequently, the augmented virtual-reality-hardware market is likely to see substantial growth as healthcare providers invest in these technologies to improve service delivery and patient care.

Rising Demand for Immersive Experiences

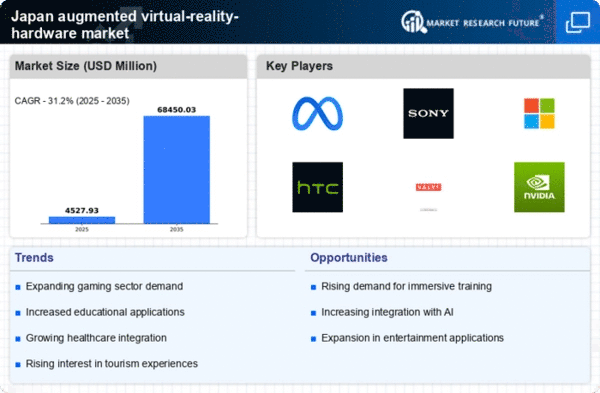

The augmented virtual-reality-hardware market in Japan is experiencing a notable surge in demand for immersive experiences across various sectors. This trend is particularly evident in the entertainment and gaming industries, where consumers are increasingly seeking more engaging and interactive content. According to recent data, the market is projected to grow at a CAGR of approximately 25% over the next five years. This growth is driven by advancements in hardware technology, which enhance the quality of virtual experiences. Furthermore, the integration of augmented reality in educational settings is also gaining traction, as institutions recognize the potential of immersive learning environments. As a result, the augmented virtual-reality-hardware market is likely to expand significantly, catering to a diverse range of applications and user preferences.

Supportive Government Policies and Initiatives

The Japanese government is actively promoting the development and adoption of augmented virtual-reality-hardware technologies through various policies and initiatives. This support includes funding for research projects, tax incentives for tech startups, and the establishment of innovation hubs focused on augmented reality. Such initiatives aim to position Japan as a leader in the global augmented reality landscape. Furthermore, the government is collaborating with educational institutions to integrate augmented reality into curricula, fostering a skilled workforce equipped to drive future innovations. As a result, the augmented virtual-reality-hardware market is likely to benefit from a conducive regulatory environment that encourages growth and technological advancement.

Expansion of E-commerce and Retail Applications

The augmented virtual-reality-hardware market is witnessing a significant expansion in e-commerce and retail applications in Japan. Retailers are increasingly leveraging augmented reality to enhance the shopping experience, allowing customers to visualize products in their own environments before making a purchase. This trend is particularly relevant in the furniture and fashion sectors, where consumers benefit from interactive and personalized shopping experiences. According to market analysis, the integration of augmented reality in retail could boost sales by as much as 20%. As more retailers adopt these technologies, the augmented virtual-reality-hardware market is expected to grow, driven by the demand for innovative shopping solutions that cater to evolving consumer preferences.

Increased Investment in Research and Development

Investment in research and development (R&D) within the augmented virtual-reality-hardware market is becoming increasingly prominent in Japan. Major technology firms and startups are allocating substantial resources to innovate and enhance their product offerings. This focus on R&D is expected to yield advanced hardware solutions that improve user experience and functionality. For instance, companies are exploring new display technologies and haptic feedback systems that could revolutionize how users interact with virtual environments. The Japanese government is also supporting this initiative by providing funding and incentives for tech companies to develop cutting-edge augmented reality solutions. As a result, the augmented virtual-reality-hardware market is likely to benefit from a continuous influx of innovative products and services, fostering a competitive landscape.