Rising Awareness and Education

Increased awareness and education regarding respiratory diseases are driving the asthma copd-drugs market in Japan. Public health campaigns and educational programs have been instrumental in informing patients about the importance of early diagnosis and effective management of asthma and COPD. As a result, more individuals are seeking medical advice and treatment options, leading to a higher demand for asthma and COPD medications. This heightened awareness is also encouraging healthcare providers to prioritize respiratory health, which may lead to increased prescriptions of asthma copd-drugs. The market is likely to benefit from this trend, as patients become more proactive in managing their conditions, thereby contributing to the overall growth of the industry.

Advancements in Drug Development

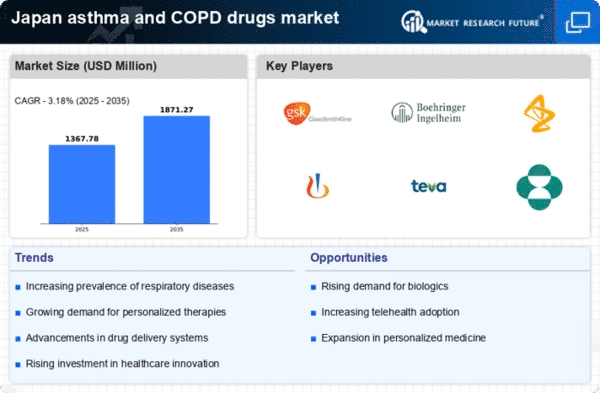

Technological advancements in drug development are significantly influencing the asthma copd-drugs market. The introduction of biologics and novel delivery systems, such as inhalers with smart technology, is transforming treatment paradigms. These innovations not only enhance drug efficacy but also improve patient adherence to treatment regimens. For instance, the development of long-acting beta-agonists (LABAs) and inhaled corticosteroids (ICS) has shown promising results in managing asthma and COPD symptoms. The market is projected to grow as these advanced therapies become more widely available, with estimates suggesting a compound annual growth rate (CAGR) of around 6% over the next five years. This growth is indicative of the industry's commitment to improving patient outcomes through cutting-edge research and development.

Regulatory Support for Drug Approvals

Regulatory support for the approval of new asthma and COPD therapies is a significant driver for the asthma copd-drugs market. The Japanese Pharmaceuticals and Medical Devices Agency (PMDA) has streamlined the drug approval process, facilitating quicker access to innovative treatments. This regulatory environment encourages pharmaceutical companies to invest in research and development, knowing that their products can reach the market more efficiently. As a result, the introduction of new therapies is expected to increase, providing patients with a broader range of options for managing their conditions. This supportive regulatory framework is likely to enhance competition within the asthma copd-drugs market, ultimately benefiting patients through improved treatment choices.

Increasing Prevalence of Respiratory Diseases

The rising incidence of respiratory diseases in Japan is a crucial driver for the asthma copd-drugs market. According to recent health statistics, approximately 10 million individuals in Japan are affected by asthma and COPD, leading to a growing demand for effective treatment options. This trend is likely to continue as the aging population increases, with older adults being more susceptible to respiratory conditions. The healthcare system is under pressure to provide adequate care, which may result in increased funding for asthma and COPD therapies. Consequently, pharmaceutical companies are focusing on developing innovative drugs to meet this demand, thereby expanding the asthma copd-drugs market. The increasing prevalence of these diseases suggests a sustained growth trajectory for the industry, as more patients seek effective management solutions.

Growing Investment in Healthcare Infrastructure

The expansion of healthcare infrastructure in Japan is positively impacting the asthma copd-drugs market. Increased government and private sector investment in healthcare facilities and services is enhancing access to respiratory care. This investment includes the establishment of specialized clinics and the integration of advanced diagnostic tools, which facilitate early detection and management of asthma and COPD. As healthcare access improves, more patients are likely to receive timely treatment, leading to a higher demand for asthma copd-drugs. The ongoing development of healthcare infrastructure suggests a favorable environment for market growth, as it aligns with the increasing need for effective respiratory disease management.