Rising Healthcare Expenditure

The increasing healthcare expenditure in the US is a significant driver for the asthma copd-drugs market. With healthcare spending projected to reach $6 trillion by 2027, there is a growing emphasis on managing chronic diseases, including asthma and COPD. This financial commitment allows for better access to medications and treatments, thereby enhancing patient care. Insurance coverage for asthma and COPD medications is also improving, which encourages patients to seek treatment. As healthcare systems prioritize chronic disease management, the asthma copd-drugs market is expected to benefit from increased funding and resources allocated to these conditions. This trend suggests a robust market environment for pharmaceutical companies focusing on respiratory therapies.

Advancements in Drug Development

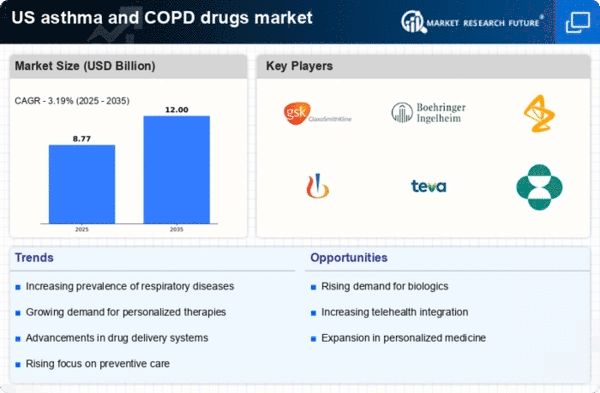

Innovations in drug development are significantly influencing the asthma copd-drugs market. The introduction of novel therapies, including biologics and targeted treatments, has transformed the management of asthma and COPD. For instance, the approval of new inhalers and combination therapies has improved patient outcomes and adherence to treatment regimens. The market is witnessing a shift towards personalized medicine, where treatments are tailored to individual patient profiles, enhancing efficacy. This trend is supported by substantial investments in research and development, with pharmaceutical companies allocating billions of $ annually to discover and develop new drugs. As these advancements continue, they are likely to drive growth in the asthma copd-drugs market, providing patients with more effective options.

Growing Awareness and Education Initiatives

There is a notable increase in awareness and education initiatives surrounding asthma and COPD, which is positively impacting the asthma copd-drugs market. Organizations and healthcare providers are actively promoting education about the symptoms, management, and treatment options for these diseases. Campaigns aimed at both patients and healthcare professionals are crucial in improving diagnosis rates and treatment adherence. As patients become more informed about their conditions, they are more likely to seek appropriate medical care and adhere to prescribed therapies. This heightened awareness is likely to drive demand for asthma and COPD medications, thereby fostering growth in the asthma copd-drugs market. The emphasis on education is expected to continue, further enhancing market dynamics.

Regulatory Support for Innovative Therapies

Regulatory bodies in the US are increasingly supportive of innovative therapies for asthma and COPD, which serves as a catalyst for the asthma copd-drugs market. The FDA has streamlined the approval process for new medications, particularly those that demonstrate significant advancements over existing treatments. This regulatory environment encourages pharmaceutical companies to invest in research and development, leading to a more diverse range of treatment options for patients. The introduction of fast-track designations and priority review processes for breakthrough therapies is likely to expedite the availability of new drugs in the market. As a result, the asthma copd-drugs market is poised for growth, driven by the influx of innovative therapies that meet the evolving needs of patients.

Increasing Prevalence of Respiratory Diseases

The rising incidence of respiratory diseases, particularly asthma and COPD, is a primary driver for the asthma copd-drugs market. According to the CDC, approximately 25 million Americans have asthma, and COPD affects around 16 million individuals. This growing patient population necessitates the development and availability of effective pharmacological treatments. As awareness of these conditions increases, more patients seek medical intervention, thereby expanding the market. The asthma copd-drugs market is projected to grow as healthcare providers focus on managing these chronic conditions, leading to increased prescriptions and sales of related medications. Furthermore, the aging population, which is more susceptible to respiratory diseases, contributes to the market's expansion, indicating a sustained demand for innovative therapies.