Regulatory Changes and Compliance

The wealth management-platform market in Italy is currently influenced by evolving regulatory frameworks. Recent changes in financial regulations necessitate that wealth management firms adapt their platforms to ensure compliance. This includes adhering to anti-money laundering (AML) laws and the Markets in Financial Instruments Directive (MiFID II). As a result, firms are investing in technology to enhance compliance capabilities, which is expected to drive growth in the market. The Italian financial authority has emphasized the importance of transparency and investor protection, leading to increased demand for platforms that can provide robust compliance features. Consequently, the wealth management-platform market is likely to see a surge in adoption as firms seek to align with these regulatory requirements.

Increased Focus on Client Experience

In the competitive landscape of the wealth management-platform market, firms in Italy are placing a heightened emphasis on enhancing client experience. This trend is driven by the recognition that personalized service and user-friendly interfaces are critical for client retention. Wealth management platforms are increasingly incorporating features such as real-time portfolio tracking and interactive financial planning tools to improve user engagement. Research suggests that firms that prioritize client experience can achieve up to 20% higher client satisfaction rates. As a result, the wealth management-platform market is likely to see innovations aimed at creating seamless and engaging client interactions, which could lead to increased market share for those firms that excel in this area.

Growing Affluence and Investment Demand

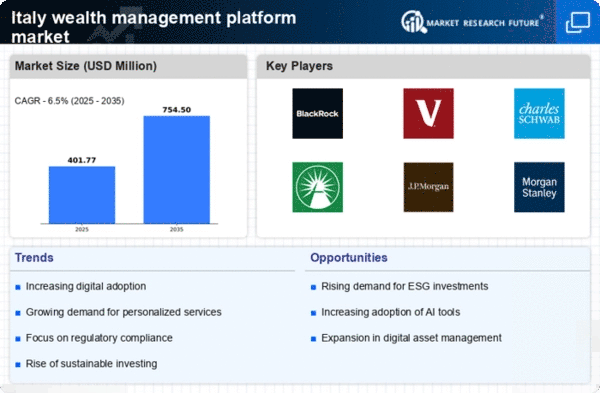

The wealth management-platform market in Italy is experiencing growth driven by an increase in affluence among the population. As more individuals attain higher income levels, there is a corresponding rise in demand for sophisticated investment solutions. Recent statistics indicate that the number of high-net-worth individuals (HNWIs) in Italy has increased by 5% over the past year, leading to a greater need for tailored wealth management services. This demographic shift is prompting wealth management firms to enhance their platforms to cater to the unique needs of affluent clients. Consequently, the wealth management-platform market is likely to expand as firms strive to attract and retain this lucrative client segment.

Shift Towards Sustainable Investment Practices

The wealth management-platform market in Italy is witnessing a notable shift towards sustainable investment practices. Investors are increasingly seeking opportunities that align with their values, particularly in environmental, social, and governance (ESG) criteria. This trend is prompting wealth management firms to adapt their platforms to offer sustainable investment options. Recent surveys indicate that approximately 70% of Italian investors express a preference for sustainable investments, which is influencing the strategies of wealth management firms. As a result, the wealth management-platform market is likely to expand as firms develop products that cater to this growing demand for responsible investing.

Technological Advancements in Financial Services

Technological innovation plays a pivotal role in shaping the wealth management-platform market in Italy. The integration of artificial intelligence (AI) and machine learning (ML) into wealth management platforms is enhancing the efficiency of investment strategies and client interactions. For instance, AI-driven analytics can provide personalized insights, which are becoming increasingly valuable to clients. Moreover, the rise of robo-advisors is transforming traditional wealth management practices, allowing firms to offer services at a lower cost. According to recent data, the adoption of AI in financial services is projected to grow by 30% annually, indicating a strong trend towards technology-driven solutions in the wealth management-platform market.