Growing Affluence and Investment Demand

The wealth management platform market in France is significantly influenced by the increasing affluence of the population. As disposable incomes rise, more individuals are seeking professional wealth management services to optimize their investments. The number of high-net-worth individuals (HNWIs) in France has been on the rise, with estimates suggesting an increase of around 5% annually. This growing demand for sophisticated investment solutions is prompting wealth management firms to enhance their platforms, offering tailored services that cater to the unique needs of affluent clients. Consequently, this trend is likely to bolster the growth of the wealth management-platform market.

Regulatory Compliance and Risk Management

The wealth management platform market in France is shaped by the evolving regulatory landscape. Financial institutions are under increasing pressure to comply with stringent regulations aimed at protecting investors and ensuring market integrity. This has led to a heightened focus on risk management solutions within wealth management platforms. Firms are investing in compliance technologies to streamline reporting and enhance transparency. The cost of non-compliance can be substantial, potentially reaching millions of euros in fines. Therefore, the emphasis on regulatory compliance is likely to drive innovation and investment in the wealth management-platform market, as firms seek to mitigate risks and enhance their operational frameworks.

Shift Towards Personalized Client Experiences

In the wealth management-platform market, there is a noticeable shift towards providing personalized client experiences. Clients are increasingly expecting tailored services that align with their individual financial goals and preferences. Wealth management firms in France are responding by leveraging data analytics to gain insights into client behavior and preferences. This allows them to offer customized investment strategies and proactive advice. As a result, firms that prioritize personalization are likely to see improved client retention and satisfaction rates. This trend is expected to contribute positively to the growth trajectory of the wealth management-platform market, as firms strive to differentiate themselves in a competitive landscape.

Technological Advancements in Financial Services

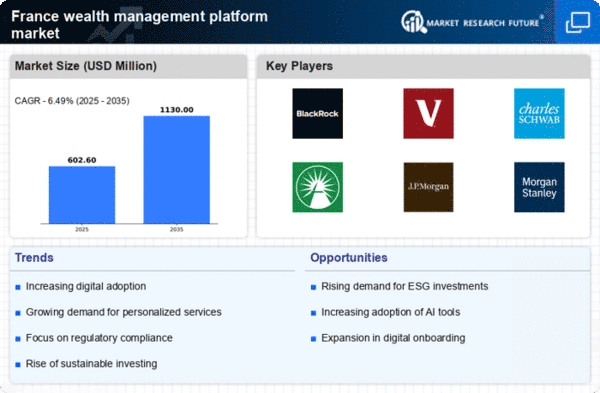

The wealth management platform market in France is experiencing a surge due to rapid technological advancements. Innovations such as artificial intelligence, machine learning, and blockchain are transforming how financial services are delivered. These technologies enhance efficiency, reduce operational costs, and improve client engagement. For instance, AI-driven analytics can provide personalized investment strategies, which are increasingly sought after by clients. The market is projected to grow at a CAGR of approximately 10% over the next five years, driven by these technological improvements. As firms adopt these technologies, they are likely to gain a competitive edge, thereby expanding their market share in the wealth management-platform market.

Integration of ESG Factors in Investment Strategies

The wealth management platform market in France is witnessing a growing emphasis on integrating environmental, social, and governance (ESG) factors into investment strategies. Investors are increasingly aware of the impact of their investments on society and the environment, leading to a demand for sustainable investment options. Wealth management firms are adapting by incorporating ESG criteria into their platforms, enabling clients to align their investments with their values. This trend is not only attracting a new demographic of socially conscious investors but is also becoming a competitive differentiator for firms. As the focus on sustainability continues to rise, the wealth management-platform market is likely to expand, driven by this integration of ESG factors.