Growing Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices significantly impacts the mobile front-haul market in Italy. As more devices become interconnected, the demand for reliable, high-capacity mobile networks increases. In 2025, it is projected that the number of IoT devices in Italy will reach over 100 million, creating a substantial need for efficient data handling and transmission. This trend necessitates implementing advanced mobile front-haul solutions to accommodate the rising data traffic generated by IoT applications. Consequently, the mobile front-haul market is likely to expand as operators seek to enhance their infrastructure to support the growing IoT ecosystem.

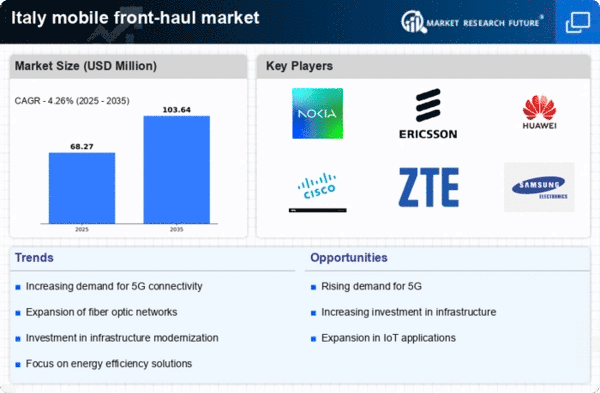

Competitive Landscape and Market Dynamics

The competitive landscape of the mobile front-haul market in Italy is evolving, with numerous players vying for market share. This competition is driving innovation and encouraging operators to enhance their service offerings. As companies strive to differentiate themselves, investments in mobile front-haul technologies are becoming increasingly common. The market dynamics suggest that operators who adopt cutting-edge solutions will likely gain a competitive edge. Additionally, partnerships and collaborations among telecom providers and technology firms are expected to foster the development of innovative mobile front-haul solutions, further propelling market growth in Italy.

Rising Demand for High-Speed Connectivity

The mobile front-haul market in Italy is experiencing a surge in demand for high-speed connectivity. This is driven by the increasing reliance on mobile data services. As consumers and businesses alike seek faster internet speeds, the need for robust mobile front-haul solutions becomes paramount. Recent data indicates that mobile data traffic in Italy is projected to grow at a CAGR of 30% over the next five years. This growth is likely to compel telecom operators to invest in advanced front-haul technologies, enhancing network performance. Consequently, the mobile front-haul market is expected to expand significantly as operators strive to meet the escalating demand for seamless connectivity and improved user experiences.

Increased Investment in Telecommunications

Investment in telecommunications infrastructure significantly drives the mobile front-haul market in Italy. The Italian government has recognized the importance of enhancing digital connectivity and has initiated various funding programs to support the expansion of telecommunications networks. In 2025, it is estimated that public and private investments in the telecommunications sector will exceed €10 billion. This influx of capital is expected to accelerate the deployment of mobile front-haul solutions, enabling operators to upgrade their networks and improve service quality. As a result, the mobile front-haul market is poised for growth, driven by the need for enhanced connectivity and competitive service offerings.

Technological Advancements in Network Infrastructure

Technological advancements are playing a crucial role in shaping the mobile front-haul market in Italy. Innovations such as virtualization, software-defined networking (SDN), and network function virtualization (NFV) are enabling operators to optimize their network infrastructure. These technologies facilitate more efficient data transmission and reduce latency, which is essential for supporting the increasing volume of mobile traffic. As operators adopt these advanced solutions, the mobile front-haul market is likely to witness substantial growth. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) into network management systems may enhance operational efficiency, thereby driving further investments in mobile front-haul technologies.