Growing Adoption of 5G Technology

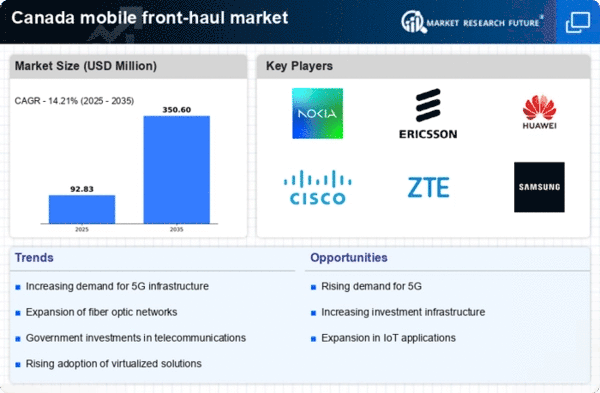

The rollout of 5G technology is a pivotal driver for the mobile front-haul market in Canada. As telecommunications companies invest heavily in 5G infrastructure, the demand for efficient front-haul solutions is intensifying. The mobile front-haul market is expected to play a vital role in supporting the high data rates and low latency that 5G promises. With projections indicating that 5G connections could reach 30 million by 2025, operators are likely to prioritize the enhancement of their front-haul networks to accommodate this influx. This transition not only necessitates significant capital investment but also encourages innovation in network design and deployment strategies, positioning the mobile front-haul market for substantial growth in the coming years.

Government Initiatives and Funding

Government initiatives in Canada are significantly influencing the mobile front-haul market. Various programs aimed at enhancing digital infrastructure are being implemented, with a focus on rural and underserved areas. The Canadian government has allocated approximately $1.7 billion to improve broadband access, which indirectly supports the mobile front-haul market. These initiatives not only promote investment in mobile networks but also encourage partnerships between public and private sectors. As a result, mobile operators are likely to expand their front-haul capabilities to align with government objectives, thereby enhancing overall network performance and accessibility. This collaborative approach may lead to a more robust mobile front-haul market, fostering innovation and improved service delivery across the country.

Rising Demand for High-Speed Connectivity

The mobile front-haul market in Canada is experiencing a surge in demand for high-speed connectivity, driven by the increasing reliance on mobile data services. As consumers and businesses alike seek faster internet access, mobile operators are compelled to enhance their network capabilities. This trend is reflected in the projected growth of mobile data traffic, which is expected to reach 50 exabytes per month by 2026. Consequently, investments in mobile front-haul infrastructure are likely to escalate, as operators aim to meet the growing expectations for speed and reliability. The mobile front-haul market is thus positioned to benefit from this heightened demand, as it plays a crucial role in facilitating the necessary bandwidth and low-latency connections required for advanced applications such as 5G and IoT.

Increased Competition Among Service Providers

The competitive landscape among service providers in Canada is driving advancements in the mobile front-haul market. As multiple operators vie for market share, there is a heightened focus on improving service quality and expanding network coverage. This competition is prompting investments in mobile front-haul infrastructure, as companies seek to differentiate themselves through superior connectivity solutions. The mobile front-haul market is likely to benefit from this dynamic, as operators explore new technologies and partnerships to enhance their offerings. Additionally, the pressure to deliver faster and more reliable services may lead to innovative approaches in network management and deployment, ultimately benefiting consumers and businesses alike.

Technological Advancements in Network Solutions

Technological advancements are reshaping the mobile front-haul market in Canada, particularly with the introduction of innovative network solutions. The emergence of software-defined networking (SDN) and network function virtualization (NFV) is enabling operators to optimize their front-haul architectures. These technologies facilitate more efficient resource allocation and management, which is essential for handling the increasing data traffic. The mobile front-haul market is likely to see a shift towards more agile and scalable network designs, allowing operators to adapt to changing demands. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) into network management systems may enhance operational efficiency, ultimately benefiting end-users through improved service quality and reduced latency.