Rising Healthcare Expenditure

Italy's increasing healthcare expenditure is another significant driver for the hip implants market. The Italian government has been investing more in healthcare services, with a reported increase of 5% in healthcare budgets over the past few years. This financial commitment is likely to enhance access to advanced medical technologies, including hip implants. As hospitals and clinics upgrade their facilities and equipment, the availability of high-quality implants is expected to improve, thereby attracting more patients. Additionally, the focus on improving patient outcomes and reducing recovery times may lead to a higher adoption rate of innovative hip implant solutions. Consequently, the rising healthcare expenditure in Italy is poised to positively impact the hip implants market, fostering an environment conducive to growth and innovation.

Increased Awareness and Patient Education

Increased awareness and patient education regarding hip health are contributing to the growth of the hip implants market. As more individuals become informed about the benefits of hip replacement surgeries, there is a noticeable rise in the number of patients seeking surgical options. Educational campaigns by healthcare providers and non-profit organizations have been instrumental in disseminating information about hip disorders and available treatments. This heightened awareness is particularly evident among older adults, who are more likely to experience hip-related issues. Moreover, as patients become more proactive in managing their health, they are increasingly discussing surgical options with their healthcare providers. This trend suggests a potential increase in demand for hip implants, as more patients opt for surgical interventions to improve their quality of life.

Government Initiatives and Support Programs

Government initiatives and support programs aimed at enhancing orthopedic care are likely to bolster the hip implants market. The Italian government has been implementing various policies to improve access to surgical procedures and reduce waiting times for patients. For instance, initiatives that promote the use of advanced surgical techniques and provide funding for orthopedic departments are becoming more common. These programs not only facilitate quicker access to hip replacement surgeries but also encourage hospitals to adopt the latest technologies in implant design and surgical methods. As a result, the hip implants market is expected to benefit from these supportive measures, leading to increased patient throughput and improved healthcare outcomes.

Technological Innovations in Implant Design

Technological innovations in implant design are transforming the hip implants market. Advances in materials science and engineering have led to the development of more durable and biocompatible implants, which are crucial for long-term success. For instance, the introduction of ceramic and highly cross-linked polyethylene materials has shown to reduce wear rates significantly, potentially extending the lifespan of implants. Furthermore, the integration of 3D printing technology allows for customized implants tailored to individual patient anatomies, enhancing surgical outcomes. These innovations not only improve patient satisfaction but also reduce the overall costs associated with revision surgeries. As these technologies become more prevalent in Italy, they are likely to drive growth in the hip implants market, as healthcare providers seek to offer the best possible solutions to their patients.

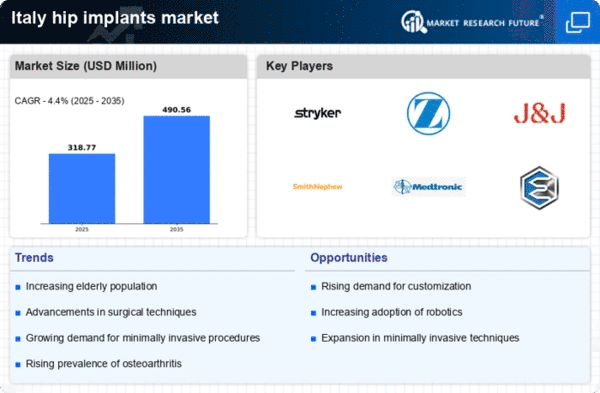

Aging Population and Increased Incidence of Hip Disorders

The aging population in Italy is a primary driver for the hip implants market. As the demographic shifts towards older age groups, the prevalence of hip disorders, such as osteoarthritis and fractures, is likely to rise. Reports indicate that approximately 20% of individuals over 65 years old experience significant hip-related issues, necessitating surgical interventions. This trend suggests a growing demand for hip implants, as older adults seek improved mobility and quality of life. Furthermore, the Italian healthcare system is adapting to these demographic changes by increasing funding for orthopedic surgeries, which may further stimulate the hip implants market. The combination of an aging population and the rising incidence of hip disorders creates a robust market environment for hip implants, indicating a sustained growth trajectory in the coming years.