Rising Cybersecurity Concerns

With the increasing digitization of public services, cybersecurity has emerged as a critical concern for the digital identity-in-government-sector market. The Italian government has recognized the need to bolster its cybersecurity framework to protect citizens' personal data and maintain trust in digital services. Reports indicate that cyberattacks targeting government systems have risen by 30% in recent years, prompting a reevaluation of security protocols. Consequently, investments in advanced cybersecurity measures are expected to surge, potentially reaching €500 million by 2026. This focus on security not only safeguards sensitive information but also encourages citizens to adopt digital identity solutions, thereby driving growth in the digital identity-in-government-sector market.

Increased Demand for Efficient Public Services

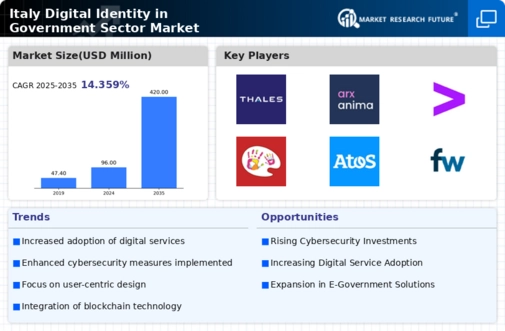

The demand for more efficient public services is a significant driver for the digital identity-in-government-sector market in Italy. Citizens increasingly expect seamless access to government services, which has led to a push for digital identity solutions that facilitate this access. As of 2025, surveys indicate that over 80% of Italians prefer online services over traditional methods, highlighting a shift in consumer behavior. This trend is likely to compel government agencies to adopt digital identity systems that streamline processes and reduce wait times. The digital identity-in-government-sector market is poised to expand as agencies seek to meet these expectations, potentially leading to a market growth rate of 15% annually.

Government Initiatives for Digital Transformation

The Italian government has been actively pursuing initiatives aimed at enhancing digital transformation across various sectors, including the digital identity-in-government-sector market. This drive is evidenced by the implementation of the Digital Administration Code, which mandates the use of digital identities for accessing public services. As of 2025, approximately 70% of public services are expected to be accessible through digital identity solutions, reflecting a significant shift towards digitalization. This initiative not only streamlines service delivery but also enhances transparency and efficiency in government operations. The digital identity-in-government-sector market is likely to benefit from increased funding and support from governmental bodies, which may further accelerate the adoption of digital identity solutions in Italy.

Legislative Support for Digital Identity Solutions

Legislative frameworks play a pivotal role in shaping the digital identity-in-government-sector market. In Italy, recent laws have been enacted to promote the use of digital identities for public services, thereby providing a legal foundation for their implementation. The introduction of the eIDAS regulation has facilitated cross-border recognition of electronic identities, which is expected to enhance the usability of digital identity solutions. As of November 2025, approximately 60% of public institutions are compliant with these regulations, indicating a robust legislative environment that supports the growth of the digital identity-in-government-sector market. This legal backing not only fosters innovation but also instills confidence among users, further driving adoption.

Technological Advancements in Identity Verification

Technological advancements are significantly influencing the digital identity-in-government-sector market in Italy. Innovations in artificial intelligence and machine learning are enhancing identity verification processes, making them more efficient and reliable. As of 2025, it is estimated that 50% of government agencies are utilizing AI-driven solutions for identity verification, which reduces the risk of fraud and improves user experience. These advancements are likely to attract more citizens to engage with digital identity solutions, as they offer enhanced security and convenience. The digital identity-in-government-sector market is expected to experience substantial growth as these technologies become more integrated into public service delivery.