Increased Regulatory Scrutiny

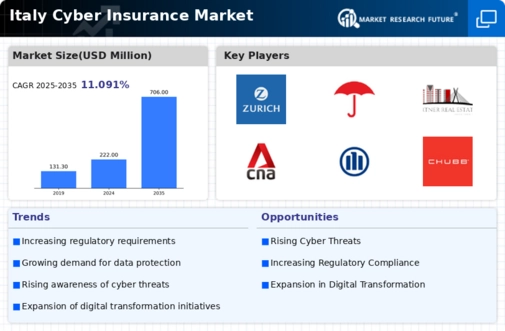

Regulatory frameworks in Italy are becoming more stringent, impacting the cyber insurance market. The introduction of laws mandating data protection and cybersecurity measures compels organizations to secure adequate insurance coverage. In 2025, it is anticipated that compliance with regulations such as the General Data Protection Regulation (GDPR) will drive a 30% increase in cyber insurance uptake among Italian firms. This regulatory environment creates a sense of urgency for businesses to protect themselves against potential fines and legal liabilities. As compliance becomes a critical factor, The cyber insurance market is likely to see a surge in demand for policies that align with regulatory requirements. This ensures businesses can navigate the complexities of legal obligations.

Rising Cyber Threat Landscape

The cyber insurance market in Italy is experiencing growth due to an increasingly complex cyber threat landscape. Cyberattacks, including ransomware and data breaches, have surged, prompting organizations to seek protection. In 2025, it is estimated that cybercrime costs could reach €10 billion annually in Italy. This alarming trend compels businesses to invest in cyber insurance as a risk management strategy. The heightened awareness of potential financial losses associated with cyber incidents drives demand for comprehensive coverage. As companies recognize the necessity of safeguarding their digital assets, The cyber insurance market is likely to expand. More tailored policies are emerging to address specific industry needs.

Growing Awareness of Cyber Risks

There is a notable increase in awareness regarding cyber risks among Italian businesses, which is positively impacting the cyber insurance market. As high-profile cyber incidents make headlines, organizations are beginning to understand the potential ramifications of inadequate cybersecurity measures. Surveys indicate that 60% of Italian companies now recognize cyber insurance as a vital component of their risk management strategy. This growing awareness is likely to drive more businesses to seek coverage, as they aim to protect their assets and reputation. The cyber insurance market is responding by offering more accessible and comprehensive policies, catering to the evolving needs of organizations that are increasingly prioritizing cybersecurity.

Digital Transformation Initiatives

The ongoing digital transformation across various sectors in Italy significantly influences the cyber insurance market. As organizations adopt advanced technologies, they inadvertently expose themselves to new vulnerabilities. In 2025, approximately 70% of Italian businesses are expected to have implemented digital solutions, increasing their reliance on digital infrastructure. This shift necessitates robust cybersecurity measures, leading to a greater demand for cyber insurance. Companies are increasingly aware that traditional insurance policies may not cover cyber risks adequately. Consequently, The cyber insurance market is evolving to provide specialized products that cater to the unique challenges posed by digital transformation. This ensures businesses can mitigate potential losses.

Emergence of Cybersecurity Partnerships

The formation of partnerships between cybersecurity firms and insurance providers is shaping the cyber insurance market in Italy. These collaborations aim to enhance the overall security posture of businesses while providing tailored insurance solutions. In 2025, it is projected that partnerships will lead to a 25% increase in the availability of specialized cyber insurance products. By leveraging expertise from both sectors, these alliances can offer comprehensive risk assessments and proactive measures, making insurance more attractive to potential clients. As businesses seek to bolster their defenses against cyber threats, The cyber insurance market is likely to benefit from this trend. This results in a more robust and informed approach to risk management.