Rising Demand for Efficiency

The advanced distribution-management-systems market in Italy is experiencing a surge in demand for operational efficiency. Companies are increasingly seeking solutions that streamline their distribution processes, reduce lead times, and minimize costs. This trend is driven by the competitive landscape, where businesses strive to enhance their service levels while maintaining profitability. According to recent data, organizations that implement advanced distribution-management systems can achieve efficiency improvements of up to 30%. This growing emphasis on efficiency is likely to propel the market forward, as firms recognize the potential for significant cost savings and improved customer satisfaction.

Focus on Cost Reduction Strategies

Cost reduction remains a primary objective for businesses in Italy, significantly impacting the advanced distribution-management-systems market. Companies are increasingly looking for ways to optimize their supply chain operations to lower costs without compromising service quality. Advanced distribution-management systems offer tools for inventory management, demand forecasting, and route optimization, which can lead to substantial cost savings. It is estimated that organizations can reduce logistics costs by up to 25% through the implementation of these systems. This focus on cost efficiency is likely to drive market growth as businesses seek to enhance their bottom line in a competitive environment.

Regulatory Compliance and Standards

The advanced distribution-management-systems market in Italy is influenced by the need to comply with various regulatory standards. Companies are required to adhere to stringent regulations regarding safety, environmental impact, and data protection. This compliance necessitates the adoption of advanced distribution-management systems that can ensure adherence to these regulations while optimizing operations. As businesses face increasing scrutiny from regulatory bodies, the demand for systems that facilitate compliance is expected to rise. This trend may lead to a market growth of approximately 15% as organizations invest in technologies that help them navigate complex regulatory landscapes.

Technological Advancements in Logistics

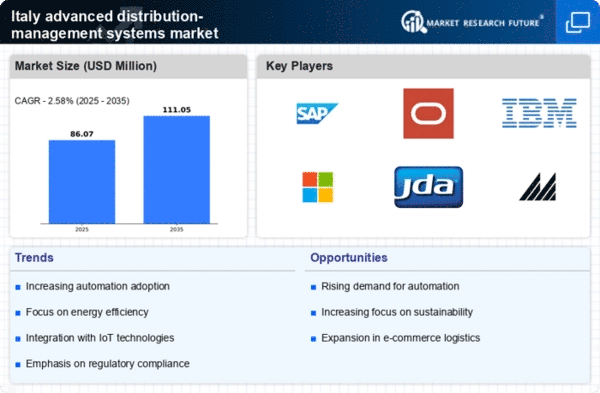

Technological innovations play a crucial role in shaping the advanced distribution-management-systems market in Italy. The integration of cutting-edge technologies such as artificial intelligence, machine learning, and the Internet of Things (IoT) is transforming logistics operations. These advancements enable real-time tracking, predictive analytics, and automated decision-making, which enhance overall supply chain visibility. As a result, companies are increasingly adopting these systems to remain competitive. The market is projected to grow at a CAGR of 12% over the next five years, driven by the need for more sophisticated logistics solutions that can adapt to changing consumer demands.

E-commerce Growth and Consumer Expectations

The rapid growth of e-commerce in Italy is a key driver for the advanced distribution-management-systems market. As online shopping continues to gain traction, consumers are demanding faster delivery times and improved service levels. This shift in consumer behavior compels businesses to adopt advanced distribution-management systems that can efficiently handle increased order volumes and ensure timely deliveries. Recent statistics indicate that e-commerce sales in Italy have surged by 20% in the past year, further emphasizing the need for robust distribution solutions. Consequently, companies are likely to invest in these systems to meet evolving consumer expectations and maintain a competitive edge.